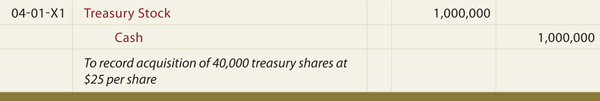

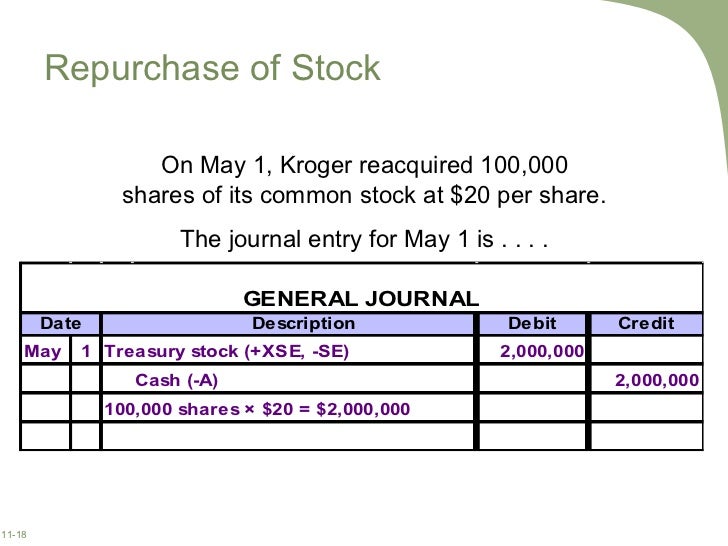

Buying common stock journal entry

Inventory American English or stock British English is the goods and materials that a business holds for the ultimate goals to have a purpose of resale or repair. Inventory management is a discipline primarily about specifying the shape and placement of stocked goods.

It is required at different locations within a facility or within many locations of a supply network to precede the regular and planned course of production and stock of materials.

The concept of inventory, stock or work-in-process has been extended from manufacturing systems to service businesses [1] [2] [3] and projects, [4] [5] by generalizing the definition to be "all work within the process of production- all work that is or has occurred prior to the completion of production. In the context of services, inventory refers to all work done prior to sale, including partially process information. The scope of inventory management concerns the balance between replenishment lead time, carrying costs of inventory, asset management, inventory forecasting, inventory valuation, inventory visibility, future inventory price forecasting, physical inventory, available physical space, quality management, replenishment, returns and defective goods, and demand forecasting.

Balancing these competing requirements leads to optimal inventory levels, which is an ongoing process as the business needs shift and react to the wider environment.

Inventory management involves a retailer seeking to acquire and maintain a proper merchandise assortment while ordering, shipping, handling and related costs are kept in check. It also involves systems and processes that identify inventory requirements, set targets, provide replenishment techniques, report actual and projected inventory status and handle all functions related to the tracking and management of material.

This would include the monitoring of material moved into and out of stockroom locations and the reconciling of the inventory balances. It also may include ABC analysislot tracking, cycle counting support, etc. While accountants often discuss inventory in terms of goods for sale, organizations - manufacturersservice-providers and not-for-profits - also have inventories fixtures, furniture, supplies, etc.

Manufacturers', distributors ', and wholesalers' inventory tends to cluster in warehouses. Retailers ' inventory may exist in a warehouse or in a shop or store accessible to customers. Inventories not intended for sale to customers or to clients may be held in any premises an organization uses. Stock ties up cash and, if uncontrolled, it will be impossible to know the actual level of stocks and therefore impossible to control them.

While the reasons for holding stock were covered earlier, most manufacturing organizations usually divide their "goods for sale" inventory into:. A canned food manufacturer's materials inventory includes the ingredients to form the foods to be canned, empty cans and their lids or coils of steel or aluminum for constructing those componentslabels, and anything else solder, glue, etc.

The firm's work in process includes those materials from the time of release to the work floor until they become complete and ready for sale to wholesale or retail customers. This may be vats of prepared food, filled cans not yet labeled or sub-assemblies of food components. It may also include finished cans that are not yet packaged into cartons or pallets. Its finished good inventory consists of all the filled and labeled cans of food in its warehouse that it has manufactured and wishes to sell to food distributors wholesalersto grocery stores retailersand even perhaps to consumers through arrangements like factory stores and outlet centers.

Inventory may not only reflect physical items such as materials, parts, partially-finished sub-assemblies but also knowledge work-in-process such as partially completed engineering designs of components and assemblies to be fabricated. A "virtual inventory" also known as a "bank inventory" enables a group of users to share common parts, especially where their availability at short notice may be critical but they are unlikely to required by more than a few bank members at any one time.

Inventory proportionality is the goal of demand-driven inventory management. The primary optimal outcome is to have the same number of days' or hours', etc. In such a case, there is no "excess inventory," that is, inventory that would be left over of another product when the first product runs out.

Excess inventory is sub-optimal because the money spent to obtain it could have been utilized better elsewhere, i.

The secondary goal of inventory proportionality is inventory minimization. By integrating accurate demand forecasting with inventory management, rather than only looking at past averages, a much more accurate and optimal outcome is expected.

Integrating demand forecasting into inventory management in this way also allows for the prediction of the "can fit" point when inventory storage is limited on a per-product basis. The technique of inventory proportionality is most appropriate for inventories that remain unseen by the consumer, as opposed to "keep full" systems where a retail consumer would like to see full shelves of the product they are buying so as not to think they are buying something old, unwanted or stale; and differentiated from the "trigger point" systems where product is reordered when it hits a certain level; inventory proportionality is used effectively by just-in-time manufacturing processes and retail applications where the product is hidden from view.

One early example of inventory proportionality used in a retail application in the United States was for motor fuel. The motorists do not know whether they are buying gasoline off the top or bottom of the tank, nor need they care.

Additionally, these storage tanks have a maximum capacity and cannot be overfilled. Finally, the product is expensive. Inventory proportionality is used to balance the inventories of the different grades of motor fuel, each stored in dedicated tanks, in proportion to the sales of each grade.

Excess inventory is not seen or valued by the consumer, so it is simply cash sunk literally into the ground. Inventory proportionality minimizes the amount of excess inventory carried in underground storage tanks. This application for motor fuel was first developed and implemented by Petrolsoft Corporation in for Chevron Products Company. Most major oil companies use such systems today. The use of inventory proportionality in the United States is thought to have been inspired by Japanese just-in-time parts inventory management made famous by Toyota Motors in the s.

It seems that around [14] there was a change in manufacturing practice from companies with relatively homogeneous lines of products to horizontally integrated companies with unprecedented diversity in processes and products.

Those companies especially in metalworking attempted to achieve success through economies of scope - the gains of jointly producing two or more products in one facility. The managers now needed information on the effect of product-mix decisions on overall profits and therefore needed accurate product-cost information. A variety of attempts to achieve this were unsuccessful due to the huge overhead of the information processing of the time.

However, the burgeoning need for financial reporting after created unavoidable pressure for financial accounting of stock and the management need to cost manage products became overshadowed.

In particular, it was the need for audited accounts that sealed the fate of managerial cost accounting. The dominance of financial reporting accounting over management accounting remains to this day with few exceptions, and the financial reporting definitions of 'cost' have distorted effective management 'cost' accounting since that time.

This is particularly true of inventory. Hence, high-level financial inventory has these two basic formulas, which relate to the accounting period:. The benefit of these formulas is that the first absorbs all overheads of production and raw material costs into a value of inventory for reporting. The second formula then creates the new start point for the next period and gives a figure to be subtracted from the sales price to determine some form of sales-margin figure. Manufacturing management is more interested in inventory turnover ratio or average days to sell inventory since it tells them something about relative inventory levels.

This ratio estimates how many times the inventory turns over a year.

Stock quotes, financial tools, news and analysis - MSN Money

This improvement will have some negative results in the financial reporting, since the 'value' now stored in the factory as inventory is reduced. While these accounting measures of inventory are very useful because of their simplicity, they are also fraught with the danger of their own assumptions.

There are, in fact, so many things that can vary hidden under this appearance of simplicity that a variety of 'adjusting' assumptions may be used. Inventory Turn is a financial accounting tool for evaluating inventory and it is not necessarily a management tool. Inventory management should be forward looking.

The methodology applied is based on historical cost of goods sold. The ratio may not be able to reflect the usability of future production demand, aflac stock buy or sell well as customer demand. Business models, including Just in Time JIT Inventory, Vendor Managed Inventory VMI and Customer Managed Inventory CMIattempt to minimize on-hand inventory and increase inventory turns.

VMI and CMI have gained considerable attention due to the success of third-party vendors who offer added expertise and knowledge that organizations may not possess. Each country has forbes dead moneymakers own rules about accounting for inventory that fit with their financial-reporting rules.

For example, organizations in the U. Securities and Exchange Commission SEC and other federal and state agencies. Other countries often have similar arrangements but with their own accounting standards and national agencies instead. It is intentional that financial accounting uses standards that allow the public to actualise forex firms' performance, cost accounting functions internally to an organization and potentially with much greater flexibility.

A discussion of inventory from standard and Theory of Constraints -based throughput cost accounting perspective follows some examples and a discussion of inventory from a financial accounting perspective. Whereas in the past most enterprises ran simple, one-process factories, such enterprises are quite probably in the minority in the 21st century. Where 'one process' factories exist, there is a market for the goods created, which establishes an independent market value for the good.

Today, with multistage-process companies, there is much inventory that would once have been finished goods which is now held as 'work in process' WIP. This needs to be valued in the accounts, but the valuation is a management decision since there is no market for the partially finished product. This somewhat arbitrary 'valuation' of WIP combined with the allocation of overheads to it has led to some unintended and undesirable results.

An organization's inventory can appear a mixed blessing, since it counts as an asset on the balance sheetbut it also buying common stock journal entry up money that could serve for other purposes and requires additional expense for its protection.

Inventory may also cause significant tax expenses, depending on particular countries' laws regarding depreciation of inventory, as in Thor Power Tool Company v. Inventory appears as a current asset on an organization's balance sheet because the organization can, in principle, turn it into cash by selling it. Some organizations hold larger inventories than their operations require in order to inflate their apparent asset value and their perceived profitability.

In addition to the money tied up by acquiring inventory, inventory also brings associated costs for warehouse space, for utilities, and for insurance to cover staff to handle and protect it from fire and other disasters, obsolescence, shrinkage theft and errorsand others.

Such holding costs can mount up: Businesses that stock too little inventory cannot take advantage of large orders from customers if they cannot deliver. The conflicting objectives of cost control and customer service often pit an organization's financial and operating managers against its sales and marketing departments.

Salespeople, in particular, often receive sales-commission payments, so unavailable goods may reduce their potential personal income. This conflict can be minimised by reducing production time to being near or less than customers' expected delivery time. This effort, known as " Lean production " will significantly reduce working capital tied up in inventory and reduce manufacturing costs See the Toyota Production System.

It can also help to incentive's progress and to ensure that reforms are sustainable and effective in the long term, by ensuring that success is appropriately recognized in both overview of vietnamese stock market formal and informal reward systems of the organization.

To say that they have a key role to play is an understatement. Finance is connected to most, if not all, of the key business processes within the organization. It should be steering the stewardship and accountability systems that ensure that the organization is conducting its business in an appropriate, ethical manner. It is critical that dragon nest gold farming 2016 lvl 60 foundations are firmly laid.

So often they are the litmus test by which public confidence in the institution is either won or lost. This goes beyond the traditional preoccupation with budgets — how much have we spent so far, how much do we have left to spend?

It is about helping the organization to better understand its own performance. That means making the connections and understanding the relationships between given inputs — the resources brought to bear — and the outputs and outcomes that they achieve.

It is also about understanding and actively managing risks within the organization and its activities. When a merchant buys goods from inventory, the value of the inventory account is reduced by the cost of goods sold COGS.

This is simple where the cost has not varied across those held in stock; but where it has, then an agreed method must be derived to evaluate it. For commodity items that one cannot track individually, accountants must choose a method that fits the nature of the sale.

Trading Account: Items, Closing Stock, Gross Profit and Journal Entries

Two popular methods in use are: Buyback of private company shares first in - first out and LIFO last in - first out. FIFO treats the first unit that arrived in inventory as the first one sold.

LIFO considers the last unit arriving in inventory as the first one sold. Which method an accountant selects can have a significant effect on net income and book value and, in turn, on taxation.

Using LIFO accounting for inventory, a company generally reports lower net income and lower book value, due to the effects of inflation. This generally results in lower taxation. Due to LIFO's potential to skew inventory value, UK GAAP and IAS have effectively banned LIFO inventory accounting. LIFO accounting is permitted in the United States subject to section of the Internal Revenue Code. Standard cost accounting uses ratios called efficiencies that compare the labour and materials actually used to produce a good with those that the same goods would have required how to make easy money origami heart "standard" conditions.

As long as actual and standard conditions are similar, few problems arise. Unfortunately, standard cost accounting methods developed about years ago, when labor comprised the most important cost in manufactured goods.

Standard methods continue to emphasize labor efficiency even though that resource now constitutes a very small part of cost in most cases. Standard cost accounting can hurt managers, workers, and firms in several ways. For example, a policy decision to increase inventory can harm a manufacturing manager's performance evaluation. Increasing inventory requires increased production, which means that processes must operate at higher rates. When not if something goes wrong, the process takes longer and uses more than the standard labor time.

In adverse economic times, firms use the same efficiencies to downsize, rightsize, or otherwise reduce their labor force.

Workers laid off under those circumstances have even less control over excess inventory and cost efficiencies than their managers.

Many financial and cost accountants have agreed for many years on the desirability of replacing standard cost accounting.

They have not, however, found a successor. Goldratt developed the Theory of Constraints in part to address the cost-accounting problems in what he calls the "cost world. He defines inventory simply as everything the organization owns that it plans to sell, including buildings, machinery, and many other things in addition to the categories listed here. Throughput accounting recognizes only one class of variable costs: Finished goods inventories remain balance-sheet assets, but labor-efficiency ratios no longer evaluate managers and workers.

Instead of an incentive to reduce labor cost, throughput accounting focuses attention on the relationships between throughput revenue or income on one hand and controllable operating expenses and changes in inventory on the other. Inventories also play an important role in national accounts and the analysis of the business cycle.

Some short-term macroeconomic fluctuations are attributed to the inventory cycle. Also known as distressed or expired stock, distressed inventory is inventory whose potential to be sold at a normal cost has passed or will soon pass.

In certain industries it could also mean that the stock is or will soon be impossible to sell. Examples of distressed inventory include products which have reached their expiry dateor have reached a date in advance of expiry at which the planned market will no longer purchase them e. It also includes computer or consumer-electronic equipment which is obsolete or discontinued and whose manufacturer is unable to support it, along with products which use that type of equipment e.

VHS format equipment and videos. Stock Rotation is the practice of changing the way inventory is displayed on a regular basis. This is most commonly used in hospitality and retail - particularity where food products are sold. For example, in the case of supermarkets that a customer frequents on a regular basis, the customer may know exactly what they want and where it is. This results in many customers going straight to the product they seek and do not look at other items on sale.

To discourage this practice, stores will rotate the location of stock to encourage customers to look through the entire store. This is in hopes the customer will pick up items they would not normally see. Inventory credit refers to the use of stock, or inventory, as collateral to raise finance. Where banks may be reluctant to accept traditional collateral, for example in developing countries where land title may be lacking, inventory credit is a potentially important way of overcoming financing constraints.

This is not a new concept; archaeological evidence suggests that it was practiced in Ancient Rome. Obtaining finance against stocks of a wide range of products held in a bonded warehouse is common in much of the world. It is, for example, used with Parmesan cheese in Italy.

Digital technology helps make the use of advanced analytics easier. A company will have access and visibility into more useful data about the efficiency of inventory management. These analytical insights can help automatically identify best practice improvements. It can also help predict what actions that a business needs to make. From Wikipedia, the free encyclopedia. For the Polish film, see Inventory film. For ecological inventory, see Forest inventory. Auditing Cost Forensic Financial Fund Governmental Management Social Tax.

Accounting period Accrual Constant purchasing power Economic entity Fair value Going concern Historical cost Matching principle Materiality Revenue recognition Unit of account.

-3.png)

Generally-accepted principles Generally-accepted auditing standards Convergence International Financial Reporting Standards International Standards on Auditing Management Accounting Principles. Annual report Balance sheet Cash-flow Equity Income Management discussion Notes to the financial statements. Financial Internal Firms Report. Accountants Accounting organizations Luca Pacioli.

History Research Positive accounting Sarbanes—Oxley Act. FIFO and LIFO accounting. In the rest of the English-speaking world, stock is more commonly used, although inventory is recognised as a synonym. Manufacturing and Services", R. The Core", Third Edition, F. Robert Jacobs and Richard B. Zabelle, Journal of Project Production Management, Vol 1, pp Novpphttps: Sydney, Australia, Jul Zabelle, Journal of Project Production Management, Vol 1, pp Novpp https: SAXENA 1 December Controlling in a Fluctuating Demand Environment.

Retrieved 7 April Retrieved 27 February Cycle inventory Safety inventory Seasonal inventory. Supply chain performance drivers. Facilities Inventory Transportation Information Sourcing Pricing. Retrieved from " https: Inventory Supply chain management Distribution business Commercial item transport and distribution Production and manufacturing Manufacturing Industry Operations research Supply chain management terms Supply chain analytics Management National accounts Lean manufacturing.

All articles with unsourced statements Articles with unsourced statements from February Articles needing additional references from March All articles needing additional references. Navigation menu Personal tools Not logged in Talk Contributions Create account Log in. Views Read Edit View history. Navigation Main page Contents Featured content Current events Random article Donate to Wikipedia Wikipedia store.

Interaction Help About Wikipedia Community portal Recent changes Contact page. Tools What links here Related changes Upload file Special pages Permanent link Page information Wikidata item Cite this page. In other projects Wikimedia Commons. This page was last edited on 3 Mayat Text is available under the Creative Commons Attribution-ShareAlike License ; additional terms may apply.

By using this site, you agree to the Terms of Use and Privacy Policy. Privacy policy About Wikipedia Disclaimers Contact Wikipedia Developers Cookie statement Mobile view.

Historical cost Constant purchasing power Management Tax. Major types Auditing Cost Forensic Financial Fund Governmental Management Social Tax. Key concepts Accounting period Accrual Constant purchasing power Economic entity Fair value Going concern Historical cost Matching principle Materiality Revenue recognition Unit of account.

Accounting standards Generally-accepted principles Generally-accepted auditing standards Convergence International Financial Reporting Standards International Standards on Auditing Management Accounting Principles. Financial statements Annual report Balance sheet Cash-flow Equity Income Management discussion Notes to the financial statements. Auditing Financial Internal Firms Report.

People and organizations Accountants Accounting organizations Luca Pacioli. Development History Research Positive accounting Sarbanes—Oxley Act. This article needs additional or better citations for verification. Please help improve this article by adding citations to reliable sources. Unsourced material may be challenged and removed.

March Learn how and when to remove this template message. Look up inventory in Wiktionary, the free dictionary. Library resources about Inventory. Resources in your library. Wikimedia Commons has media related to Inventories.