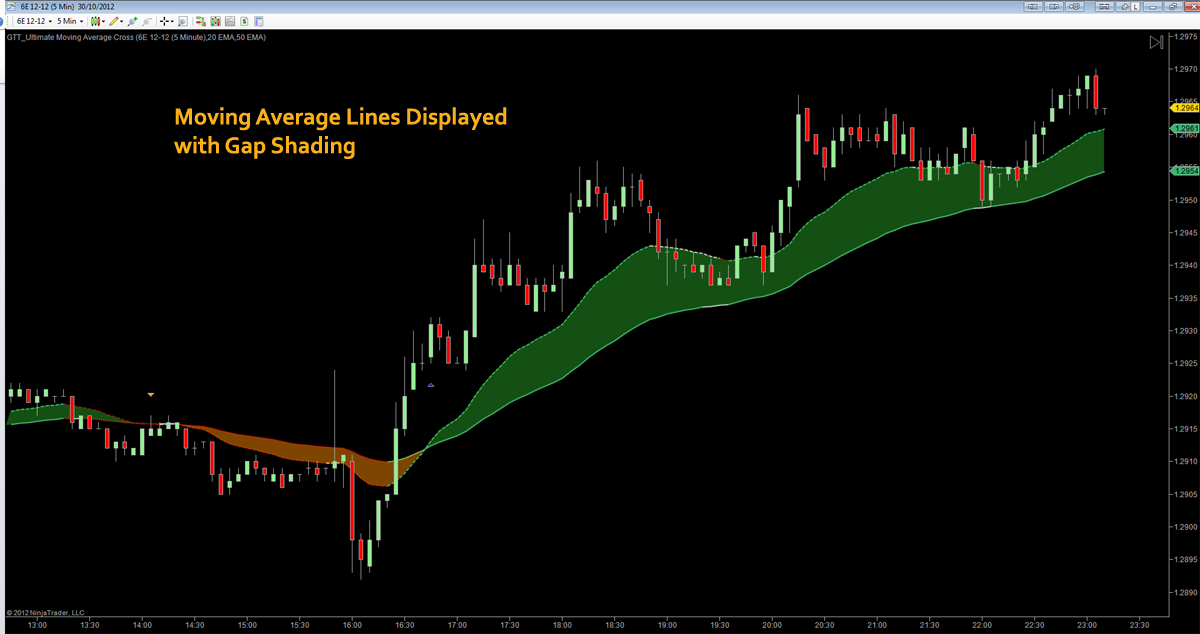

Forex moving average crossover indicator

A forex trader can create a simple trading strategy to take advantage of low-risk, high-reward trading opportunities using just a few moving averages MAs. Moving averages are perhaps the most commonly used technical indicators in forex trading. MAs are used primarily as trend indicators and also identify support and resistance levels. In forex trading, the day, day, and day MAs are considered to represent significant support and resistance levels.

The two most frequently used MAs are the simple moving average SMA , which is the average price over a given number of time periods, and the exponential moving average EMA , which gives more weight to recent prices. Outlined below is a trading strategy designed for short-term, intraday trading in the forex market.

Simple Moving Average Strategy - How to Use the SMA in Forex Trading

This trading strategy uses EMAs because it is designed to respond quickly to price changes. For a sell trade, sell when price and the five-period EMA cross from above to below the period EMA. As long as the price is above the period EMA on the hourly chart, then only buy trade signals are taken. If the price is below the period EMA, only sell trades are entered. Move the stop to break even when the trade is 10 pips profitable. Since this is a short-term trading strategy, move the stop-loss aggressively as the profit showing in the trade increases.

Forex traders often use a short-term MA crossover of a long-term MA as the basis for a trading strategy.

Dictionary Term Of The Day. A measure of what it costs an investment company to operate a mutual fund. Latest Videos PeerStreet Offers New Way to Bet on Housing New to Buying Bitcoin?

This Mistake Could Cost You Guides Stock Basics Economics Basics Options Basics Exam Prep Series 7 Exam CFA Level 1 Series 65 Exam. Sophisticated content for financial advisors around investment strategies, industry trends, and advisor education. How do I use Moving Average MA to create a forex trading strategy? By Investopedia December 23, — 5: Use the exponential moving average EMA to create a dynamic forex trading strategy.

Learn how EMAs can be utilized very Utilize additional technical indicators to complement and improve a basic trading strategy that relies on exponential moving Learn the formula for calculating both simple moving averages and exponential moving averages, indicators that are frequently Learn a basic forex trading strategy that can be implemented using a trading signal generated by a crossover movement by Learn the important potential advantages of using an exponential moving average when trading, instead of a simple moving Learn about exponential moving averages and how to use the exponential moving average crossover for swing trading to signal These technical indicators help investors to visualize trends by smoothing out price movements.

The relationship between price, day EMA and its slope of generate useful patterns that assist in price prediction and trade management.

Find out how this simple trading strategy can be added into your trading arsenal. Investors focus on fundamental criteria to choose portfolio candidates but adding moving averages to their analysis will improve long-term performance.

These two banks show major rejection at long-term resistance and could test their first quarter lows.

Moving Average Cross Strategy — Forex Trading Strategy

Here are the guidelines for making trading decisions using the force index in both a short and intermediate perspective. Learn this simple momentum strategy and its profit protecting exit rules.

The Moving Average indicator is one of the most useful tools for trading and analyzing financial markets. A type of moving average that is similar to a simple moving average, A market breadth indicator that is based on the difference between A technical momentum indicator that helps traders determine overbought An expense ratio is determined through an annual A hybrid of debt and equity financing that is typically used to finance the expansion of existing companies.

A period of time in which all factors of production and costs are variable. In the long run, firms are able to adjust all A legal agreement created by the courts between two parties who did not have a previous obligation to each other. A macroeconomic theory to explain the cause-and-effect relationship between rising wages and rising prices, or inflation.

A statistical technique used to measure and quantify the level of financial risk within a firm or investment portfolio over Content Library Articles Terms Videos Guides Slideshows FAQs Calculators Chart Advisor Stock Analysis Stock Simulator FXtrader Exam Prep Quizzer Net Worth Calculator. Work With Investopedia About Us Advertise With Us Write For Us Contact Us Careers. Get Free Newsletters Newsletters.

All Rights Reserved Terms Of Use Privacy Policy.