Realised and unrealised foreign exchange gains

STRATEGIC REPORT - OVERVIEW OF STRATEGY.

How are Unrealized and Realized Gain and Loss Accounts Used?

The aim of the Company is to achieve a total return greater than its benchmark by investing predominantly in equities worldwide. Within this objective, the Manager will seek to increase the Company's revenues in order to maintain an above average dividend yield. The Company's investment objective and financial highlights are shown in the Strategic Report. A review of the Company's activities is given in the Chairman's Statement and the Investment Management Review on.

The Chairman's Statement and Manager's Review include an analysis of the business of the Company and its principal activities, likely future developments of the business, the recommended dividend and details of any acquisition of its own shares by the Company. The Company's assets are invested in a diversified portfolio of international equities and fixed income securities spread across a range of industries and economies.

The Company's investment policy is flexible and it may, from time to time, hold other securities including but not limited to index-linked securities, convertible securities, preference shares, unlisted securities, depositary receipts and other equity-related securities. The Company may invest in derivatives for the purposes of efficient portfolio management.

The Company's investment policy does not impose any geographical, sectoral or industrial constraints upon the Manager. The Board has set guidelines which the Manager is required to work within from meeting to meeting. The Company currently does not have any investments in other investment companies.

The Manager actively monitors the Company's portfolio and attempts to mitigate risk primarily through diversification. The Board considers that returns to shareholders can be enhanced by the judicious use of borrowing. The Board is responsible for the level of gearing in the Company and reviews the position on a regular basis.

Any borrowing, except for short-term liquidity purposes, is used for investment purposes or to fund the purchase of the Company's own shares. At the year end, there was net gearing of Any material change to the investment policy will require the approval of the shareholders by way of an ordinary resolution at a general meeting. The Company will promptly issue an announcement to inform the shareholders and the public of any change of its investment policy.

Day-to-day management of the Company's assets has been delegated to the Manager. The Manager invests in a diversified range of international companies in accordance with the investment objective.

The portfolio manager, Bruce Stout, has responsibility for portfolio construction across all regional segments. As can be seen from the business model contained in the Annual Report, the Aberdeen management team utilises a "Global Equity Buy List" which is constructed by each of the specialist country management teams. This list contains all buy and hold recommendations for each management team, which are then used by the portfolio manager as the Company's investment universe.

Stock selection is the major source of added value. Top-down investment factors are secondary in the Manager's portfolio construction, with stock diversification rather than formal controls guiding stock and sector weights.

Market capitalisation is not a primary concern. A detailed description of the investment process and risk controls employed by the Manager is disclosed in the Annual Report. A comprehensive analysis of the Company's portfolio is disclosed below including a description of the twenty largest investments, the portfolio of investments by value, attribution analysis, distribution of investments and distribution of equity investments.

In addition to equity exposures, the investment mandate provides the flexibility to invest in fixed income securities.

The process of identifying, selecting and monitoring both sovereign and corporate bonds follows exactly the same structure and methodology as that for equity investment, fully utilising the global investment resources of the Manager. As in the case of equity exposure, the total amount, geographical preference, sector bias and specific securities will ultimately depend upon relative valuation and future prospects.

At the year end the Company's portfolio consisted of 48 equity and 24 bond holdings. The Manager is authorised by the Board to hold between 45 and stocks in the portfolio. The Company's Alternative Investment Fund Manager is Aberdeen Fund Managers Limited "AFML" which is authorised and regulated by the Financial Conduct Authority Day to day management of the portfolio is delegated to Aberdeen Asset Managers Limited "AAM".

AAM and AFML are collectively referred to as the "Investment Manager" or the "Manager". The Board uses a number of financial performance measures to assess the Company's success in achieving its objective and determine the progress of the Company in pursuing its investment policy. The main KPIs identified by the Board in relation to the Company which are considered at each Board meeting are as follows: The Board considers the Company's NAV total return figures to be the best indicator of performance over time and these are therefore the main indicators of performance used by the Board.

The Board also measures performance against the Benchmark and performance relative to competitor investment trusts over a range of time periods, taking into consideration the differing investment policies and objectives employed by those companies.

The Board also monitors the price at which the Company's shares trade relative to the Benchmark on a total return basis over time. A graph showing absolute, relative and share price performance is shown in the Annual Report.

The Board's aim is to seek to increase the Company's revenues over time in order to maintain an above average dividend yield. Dividends paid over the past 10 years are set out in the Annual Report. The Board's aim is to ensure that gearing is kept within the Board's guidelines issued to the Manager. There are a number of risks which, if realised, could have a material adverse effect on the Company and its financial condition, performance and prospects.

The Board has undertaken a robust review of the principal risks and uncertainties facing the Company including those that would threaten its business model, future performance, solvency or liquidity. Those principal risks are disclosed in the table below together with a description of the mitigating actions taken by the Board.

The principal risks associated with an investment in the Company's shares are published monthly on the Company's factsheet or they can be found in the pre-investment disclosure document "PIDD" published by the Manager, both of which are available on the Company's website. Potential issues relating to the work of the Audit Committee are discussed in the Report of the Audit Committee in the Annual Report and further detail on financial risks and risk management is disclosed in note 18 to the financial statements.

The Board regularly reviews the risks and uncertainties faced by the Company in the form of a risk matrix and a summary of the principal risks is set out below. Investment strategy and objectives - if the Company's investment objective becomes unattractive and the Company fails to adapt to changes in investor demand, the Company may become unattractive to investors, leading to decreased demand for its shares and a widening discount.

In addition, the Board is updated at each Board meeting on the make up of and any movements in the shareholder register and the Directors attend meetings with shareholders. Investment portfolio, investment management - investing outside of the investment restrictions and guidelines set by the Board could result in poor performance and inability to meet the Company's objectives.

The Board sets, and monitors, its investment restrictions and guidelines, and receives regular Board reports which include performance reporting on the implementation of the investment policy, the investment process and application of the guidelines. The Manager attends all Board meetings. The Board also monitors the Company's share price relative to the NAV. Financial obligations - the ability of the Company to meet its financial obligations, or increasing the level of gearing, could result in the Company becoming over-geared or unable to take advantage of potential opportunities and result in a loss of value to the Company's shares.

The Board sets a gearing limit and receives regular updates on the actual gearing levels the Company has reached from the Manager together with the assets and liabilities of the Company and reviews these at each Board meeting. In addition, AFML, as alternative investment fund manager in conjunction with the Board, has set an overall leverage limit of 2. Financial and Regulatory - the financial risks associated with the portfolio could result in losses to the Company.

In addition, failure to comply with relevant regulation including the Companies Act, the Corporation Taxes Act, the Alternative Investment Fund Managers Directive, Accounting Standards and the FCA's Listing Rules, Disclosure and Prospectus Rules may have an impact on the Company.

The financial risks associated with the Company include market risk, liquidity risk and credit risk, all of which are mitigated in conjunction with the Manager.

Further details of the steps taken to mitigate the financial risks associated with the portfolio are set out in note 18 to the financial statements. The Board relies upon the Aberdeen Group to ensure the Company's compliance with applicable regulations and from time to time employs external advisers to advise on specific concerns. Operational - the Company is dependent on third parties for the provision of all systems and services in particular, those of Aberdeen Asset Management and any control failures and gaps in these systems and services could result in a loss or damage to the Company.

The Board receives reports from the Manager on internal controls and risk management at each Board meeting. It receives assurances from all its significant service providers, as well as back to back assurance from the Manager at least annually. Further details of the internal controls which are in place are set out in the Directors' Report. The Company does not have a fixed period strategic plan but the Board formally considers risks and strategy at least annually.

The Board considers the Company, with no fixed life, to be a long term investment vehicle but, for the purposes of this viability statement, has decided that a period of five years is an appropriate period over which to report. The Board considers that this period reflects a balance between looking out over a long term horizon and the inherent uncertainties of looking out further than five years.

In assessing the viability of the Company over the review period the Directors have focussed upon the following factors: Accordingly, taking into account the Company's current position, the fact that the Company's investments are mostly liquid and the potential impact of its principal risks and uncertainties, the Directors have a reasonable expectation that the Company will be able to continue in operation and to meet its liabilities as they fall due for a period of five years from the date of this Report.

In making this assessment, the Board has considered that matters such as significant economic or stock market volatility, a substantial reduction in the liquidity of the portfolio or changes in investor sentiment could have an impact on its assessment of the Company's prospects and viability in the future.

The Board recognises the importance of communicating the long-term attractions of your Company to prospective investors both for improving liquidity and for enhancing the value and rating of the Company's shares. The Board believes an effective way to achieve this is through subscription to and participation in the promotional programme run by the Aberdeen Group on behalf of a number of investment companies under its management.

The Company also supports the Aberdeen Group's investor relations programme which involves regional roadshows, promotional and public relations campaigns. The purpose of these initiatives is both to communicate effectively with existing shareholders and to gain new shareholders with the aim of improving liquidity and enhancing the value and rating of the Company's shares.

The Company's financial contribution to the programmes is matched by the Aberdeen Group. The Aberdeen Group Head of Brand reports quarterly to the Board providing an analysis of the promotional activities as well as updates on the shareholder register and any changes in the make up of that register. The Board recognises the importance of having a range of skilled, experienced individuals with the right knowledge represented on the Board in order to allow the Board to fulfil its obligations.

The Board also recognises the benefits, and is supportive, of the principle of diversity in its recruitment of new Board members. At 31 Decemberthere were four male Directors and two female Directors on the Board. The Company has no employees as the Board has delegated day to day management and administrative functions to Aberdeen Fund Managers Limited. There are therefore no disclosures to be made in respect of employees. The Company's socially responsible investment policy is outlined below.

Due to the nature of the Company's business, being a Company that does not offer goods and services to customers, the Board considers that it is not within the scope of the Modern Slavery Act because it has no turnover. The Company is therefore not required to make a slavery and human trafficking statement.

The Company supports the UK's Stewardship Code, and seeks to play its role in delivering good stewardship of the companies in which it invests. While the delivery of stewardship activities has been delegated to the Manager, the Board acknowledges its role in setting the tone for the effective delivery of stewardship on the Company's behalf. Further details on stewardship may be found in the Annual Report.

The Company has no greenhouse gas emissions to report from the operations of its business, nor does it have responsibility for any other emissions producing sources under the Companies Act Strategic Report and Directors' Reports Regulations I am pleased to report that, during the year to 31 Decemberthe Company's net asset value "NAV" posted a total return i.

Over the period, the share price posted a total return of The Manager's Review gives further details of the performance outturn, including an attribution analysis which shows the factors affecting NAV performance. After a difficult performance period in the prior three years, the continuing focus on geographical diversification and investment in companies with strong business franchises and shareholder friendly managements was rewarded in the period.

Three interim dividends of Your Board is now recommending a final dividend of If approved, the total Ordinary dividends for the year will amount to As I have alluded to in previous years, the Company's revenue is substantially derived from overseas companies, which pay dividends in local currencies that are then translated into Sterling upon receipt.

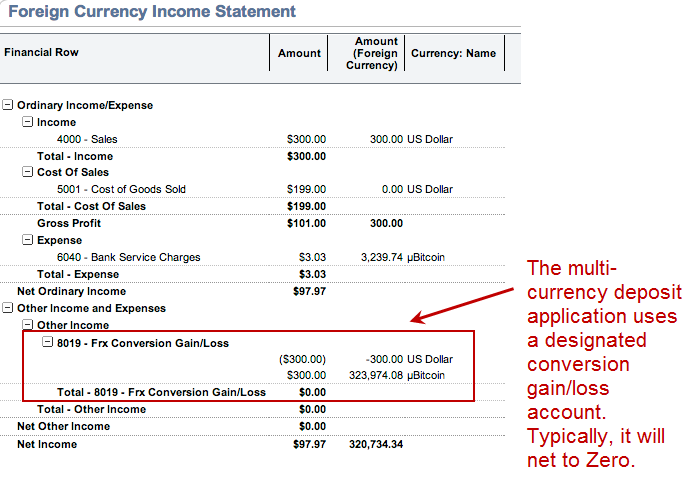

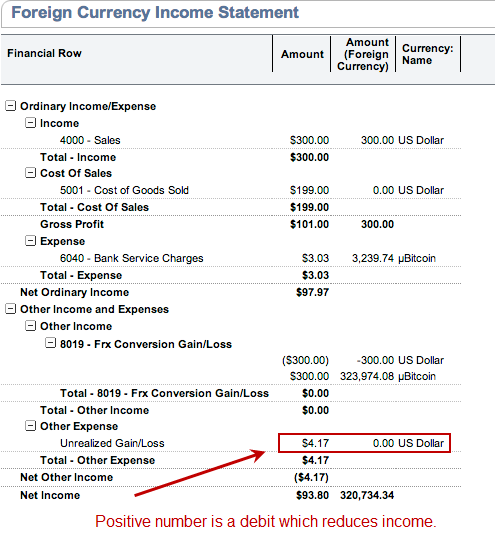

Recording Unrealized Currency Gains and Losses / How To / Knowledge Base - AccountEdge Support

The Company's revenue streams are therefore highly susceptible to the strength or weakness of Sterling. The Board and the Manager conducted a study during the year to consider the merits of hedging expected annual revenues arising from the portfolio. The analysis showed that these hedging strategies would add complexity and for certain currencies be very expensive to implement, and therefore concluded that they would be unattractive to deploy.

The inevitable consequence of this is that the annual revenue from the portfolio, when translated into Sterling, will experience volatility caused by Sterling's movements against the currencies of the underlying assets of the Company.

These effects can be large as evidenced by the favourable impact of Sterling's decline in In other years the effect may be in the opposite direction if Sterling generally appreciates. The Board intends to maintain a progressive dividend policy given the Company's investment objective. This means that in some years revenue will be added to reserves, while in others revenue may be taken from reserves to supplement earned revenue for that year, to pay the annual dividend.

Shareholders should not be surprised or concerned by either outcome as over time the Company will aim to pay out what the underlying portfolio earns. During the year, we purchased in the market 1, Ordinary shares at a discount to NAV for holding in Treasury and we issuedshares from Treasury at a premium to NAV. The Board will be seeking approval from shareholders to renew both authorities in As in previous years, both new shares and shares from Treasury will only be issued at a premium to NAV and shares will only be bought back at a discount to NAV.

Resolutions to this effect will be proposed at the Annual General Meeting and the Directors strongly encourage shareholders to support these proposals. During the year the Ordinary shares have traded at an average premium to exclusive of income NAV of 0.

The Board continues to believe that it is appropriate to seek to address temporary imbalances of supply and demand for the Company's shares which might otherwise result in a recurring material discount or premium. Subject to existing shareholder permissions given at the last AGM and prevailing market conditions over time, the Board intends to continue to buy back shares and issue new shares or sell shares from Treasury if shares trade at a persistent significant discount to NAV excluding income or premium to NAV including income.

The Board believes that this process is in all shareholders' interests as it seeks to reduce volatility in the premium or discount to underlying NAV whilst also making a small positive contribution to the NAV.

At the time of writing, the exclusive of income NAV per share was At the same time, the Company also repaid from its cash balances the YEN 1.

This year's Annual General Meeting will be held in Glasgow on 25 April at As at previous AGMs, there will be a presentation from the Manager and an opportunity to meet the Directors and Manager over lunch.

I should be grateful if you would confirm your attendance by completing the separate notice that will accompany the Annual Report, and returning it together with an indication of any particular questions.

I hope to see as many shareholders as possible at the AGM in Glasgow. Following receipt of approval from shareholders at the general meetings held in Aprilall remaining B Ordinary shares in issue on 30 June were converted into Ordinary shares with effect from 1 July and there was a bonus issue of one new Ordinary share for every B Ordinary shares held.

The final conversion and bonus issue resulted in the issue ofnew Ordinary shares on 1 July The Board believes that the Company's capital structure is now simpler and more straightforward for both existing and potential shareholders, in addition to which there will also be future cost savings achieved from the exercise.

I would like to reiterate the Board's sincere thanks to Lady Balfour of Burleigh, CBE, following her retirement at the AGM held in April Mrs Alexandra Mackesy joined the Board on 1 May and we are already benefitting from her extensive experience. Alexandra is a former investment equity research analyst by background and, having spent the majority of her executive career in Asia, she brings significant global perspective to the Board. The Board notes the recent announcement of the proposed recommended merger between the Company's Manager, Aberdeen Asset Management PLC, and Standard Life plc.

It is still early days in this transaction which is subject to shareholders' and regulatory approvals. The Board has sought and obtained assurances that the existing investment management and client servicing team from Aberdeen will remain in place and focussed on the Company's affairs, and we will be vigilant to ensure this remains the case. It is seldom relevant to focus too intensively on politics when considering the global investment outlook, but the outcomes of the Referendum on 23 June in the UK and the Presidential Election on 8 November in the United States carry serious ramifications that cannot be ignored.

Whilst it is premature to draw firm conclusions about the likely consequences, we do know that additional uncertainty will prevail. History teaches us how much financial markets dislike uncertainty. There is an unquantifiable threat to global trade and currency stability, and a potential change in the rules of free-market economics is unlikely to sit comfortably with capital markets.

This environment is likely to produce abnormal shifts in sentiment in markets as investors gather on one or other side of the perceived merits of being exposed to risky assets. This will produce opportunities for patient investors who remain focused on holding a broadly diversified portfolio of companies with robust business models, strong market positions and solid financial disciplines. The Board and the Manager intend to continue with such an approach as the means of delivering the Company's investment objective over time.

Even so, is likely to provide a stern test for financial markets and the delivery of the Company's investment objective. It is said the most valuable currency in the world is trust. Earned through honesty, integrity and truth, where it exists, the possibilities are endless. Inspiring confidence for individuals, business and government, trust allows financial activity to flourish. Without it, there can be no commercial exchange, no international trade, no global investment and no social democracy.

In a world increasingly frustrated by unfulfilled promises and austerity fatigue, the single most influential global development over the past twelve months was the dramatic devaluation of trust. As Central Banks, the political elite, academia and the media were seen increasingly to be out of touch with public opinion and detached from the disconnect between policy and reality, respect for them tangibly eroded. The political cost associated with such widespread trust debasement proved deep and far-reaching.

Anti-establishment sentiment escalated on a wave of nationalistic populism, securing power and elected representation seemingly against the odds and often against public opinion. In a global political climate where it became prudent to expect the unexpected, leadership change, policy change and government change swept across the landscape.

Credibility loss was most pronounced towards Central Bank policymakers. Four consecutive years of grossly inaccurate economic forecasting condemned the Federal Reserve in the United States to making increasingly hollow-sounding policy predictions. Domestic interest rates were nudged up slightly, but widespread scepticism prevailed.

Similar doubt and indecision accompanied policy directives in the UK. The Bank of England's fragile veneer of respectability was shattered following Britain's vote to leave the European Union. Hostage to unsustainable fiscal and current account deficits, the Brexit Referendum result delivered the long expected devaluation of Sterling as international capital took fright.

In the ensuing temporary panic, policy discipline was abandoned. Displaying infinitely more consistency in futile policy implementation, the European Central Bank and the Bank of Japan kept on printing banknotes. Creating farce and fallacy whilst simultaneously destroying hard earned savings, such actions were beyond contempt. Yet oblivious to public derision, global Central Bank policymakers ploughed on regardless, in denial of the painfully obvious - issuing more debt to solve a debt crisis simply doesn't work.

Accompanying withering trust in establishment orthodoxy was escalating anxiety over economic performance. The predominant mood of influence early in the period had been one of deflation. Declining global growth forecasts, combined with extreme commodity price weakness, had politicians and policymakers paralysed from persistent macro-economic disappointment.

Impotent to influence evolving events, they watched as global bond yields plunged to historic lows. When Germany issued a ten year bond yielding zero in the summer, the monetary vandalism descended to new depths. Such actions proved not just offensively ironic but also the ultimate insult to savers.

Widespread condemnation of global economic management intensified and into the economic vacuum flowed the language of change.

Based on neither sense nor substance, promises of increased fiscal spending, tax cuts, job creation, higher wages and economic reinvigoration became the lexicon of choice.

All talk, no action but disillusioned voters embraced such reflationary rhetoric with great gusto. The half-empty glass became not just half full but somehow positively overflowing! Choosing to ignore systemically entrenched excessive debt, lingering over-capacity, fiscal insolvency, income impoverishment and deficient demand, sentiment soared in anticipation of stronger growth and higher corporate profits in the future. The effects on equity, bond and currency markets were nothing short of remarkable.

Weakness in Sterling against virtually all its major trading partners had significant influence on overall portfolio returns. Suffice to say the overall depreciation of Sterling materially enhanced capital and income returns of the Trust. Latin America provided the strongest regional equity market returns in Sterling terms, up Behind the benchmark strength, Brazil excelled against a backdrop of declining bond yields, interest rate cuts, political resolution and currency strength.

The portfolio benefitted significantly from its Brazilian bond and equity exposure, both in terms of income enhancement and capital appreciation. Conversely, sentiment towards Mexico suffered from vitriolic bile associated with Republican campaigning in the United States. Portfolio holdings were not unduly affected but progress was unequivocally constrained.

Somewhat surprisingly, North American equity markets surged to record highs despite further declines in corporate profits. Momentum eclipsed fundamentals, particularly during the final six week, post-election rally. Rising protectionism fears and associated weakness in Chinese equities slightly restrained what otherwise proved exceptionally strong returns from Asia ex Japan.

Similarly Japan, although fundamentally deteriorating from ineffective monetary policy and structural economic malaise, kept pace with most global markets. Ongoing political wrangling between the UK and Europe coupled with numerous profit warnings from leading UK and European companies at times haunted the Eurozone backdrop. The UK market clung onto historical highs set towards year end, but conviction investing remained absent from a fragile environment of rising tensions and increased nationalism.

Last, but not least, provided powerful positive returns from the portfolio's emerging market bond portfolio. A total return of The top five and bottom stock contributors are detailed below: The attribution analysis below details the various influences on portfolio performance. In summary, of the 8. Structural effects, relating to the fixed income portfolio and gearing net of borrowing and hedging costs, added a further 6.

Notes to Performance Analysis. Asset Allocation effect - measures the impact of over or underweighting each asset category, relative to the benchmark weights.

Stock Selection effect - measures the effect of security selection within each category. Share Issuance - the enhancement to performance of new shares being issued at premium to NAV. Technical differences - the impact of different return calculation methods used for NAV and portfolio performance. Figures may appear not to add up due to rounding. America's domestic economic landscape continued to polarise opinion. This ranged between those emphasising deflationary risks associated with a chronically over indebted nation and those accentuating potential inflationary pressures inherent with maintaining abnormally low interest rates.

Neither side produced sufficient evidence to unequivocally prove their point. The net result was policy inertia. For the marginalised American, desperate for clarity on employment, wages and onerous debt obligations, such policy paralysis proved unwelcome.

To fill the void, increasingly radical political promises were made, cumulating in profound changes to government and leadership ideology. Financial markets, forever eager to embrace exuberance, indiscriminately accentuated perceived positives.

Exactly why such emotive rhetoric should inspire such unquestioning confidence is unfathomable. Beyond electoral promises, US economic fundamentals dictate a very different reality. The current business expansion arguably shows signs of increasing exhaustion. Seven consecutive quarterly declines in US corporate profits eclipse the unenviable record set in the s, unequivocally illustrating the fatigue in US earnings momentum.

Rising bond yields, and more importantly a stronger dollar, would only further compress corporate margins. Clearly Americans want to believe in the revival of animal spirits but declining corporate profits have long been associated with the end of business cycles, not the beginning.

Will four jingoistic words deliver what four trillion dollars of monetary largesse could not? In rational terms it is reasonable to doubt. The sheer enormity of US debt suggests deflationary risks remain. Unless policymakers are irresponsible enough to impose significant losses on creditors, then the debt overhang remains.

Meantime the US Monetary Authorities attempt to set policy within an opaque fiscal landscape full of speculation and supposition. Delivering election promises are likely to be infinitely more difficult than pronouncing them. Portfolio exposure, focused on defensive above-average yielding businesses, performed well under the circumstances with overall returns exceeding those of the market.

All seven North American holdings appreciated over the period, with core telecommunications holdings in Verizon and Telus particularly strong. Profit-taking in consumer staples reduced total exposure to Economic sceptics maintain that in the purest form of democracy, everyone gets what nobody wants. If rational expectations dictate decision making, then economic choice is enhanced by certainty and stability. The conclusion of yet another turbulent twelve months in UK economic history witnessed almost the exact opposite prevailing.

The seismic shock associated with Britain's vote to leave the European Union reverberated around every aspect of domestic activity. For the elected UK Government, Brexit meant Brexit, but for the beleaguered UK economy Brexit meant exactly what?

Realized and Unrealized Gains and Losses • The Strategic CFO

Within the eerie silence that descended, nothing could accurately be assessed about future investment, international trade, immigration, employment, security or growth simply because no precedent existed. Into the vacuum stepped the speculators of doom and gloom, or progress and prosperity depending on which unsubstantiated illusion the respective orator wished to emphasise.

Into the vacuum also ventured the Bank of England with perhaps the most inexpedient interest rate cut in living memory. For an economy already burdened with unsustainable current account and budget deficits, excessively leveraged public and private sectors, stagnating real incomes and over-extended property prices such additional uncertainty proved extremely unwelcome.

Sterling plunged as the UK's Achilles Heel of foreign capital dependency was cruelly exposed. For the broader public, and more importantly its diminishing disposable income, currency devaluation quickly translated into higher import costs.

Inelastic necessities, such as food and energy, witnessed sharply higher prices which in turn rekindled inflationary concerns and pushed bond yields higher.

For businesses, tough decisions on capital allocation between investment and cost containment became infinitely more problematic. Somewhat surprisingly, with the seeds of economic recession being scattered all around, for those disciples of profitless prosperity none of this mattered.

The UK equity market maintained its upward momentum with complete disregard to fundamental fragilities. Ignoring growing threats to corporate profitability and dividend cover, by year end the FTSE had surpassed historical highs set sixteen years ago. Unimpressed by extended valuations against such an opaque economic and political backdrop, UK investment was maintained around historical lows.

From a performance perspective, UK portfolio exposure - or more accurately lack of UK exposure - contributed most to relative returns. Superior stock selection in a market that trailed all other regional indices proved very beneficial.

Strong stock selection from holdings in Weir Group, BHP Billiton and Royal Dutch Shell enhanced both absolute and relative performance, with only Vodafone disappointing against expectation. A new position in leading satellite company Inmarsat was initiated, with a long term view towards its involvement in the provision of internet for global airlines. The European Central Bank remained uncomfortably ensnared in its self-made monetary trap throughout Hostage to policy-obsessed financial markets, policymakers intensified futile monetary attempts to reinvigorate economic activity.

Escalating purchases of troublesome sovereign and corporate debts from crippled European banks failed to stimulate activity. Designed to relieve the debt burdens of domestic banks, yet again such practices merely transferred private sector debt obligations onto the public balance sheet. The legacy of existing, non-performing loans remains a powerful contractionary force that will haunt Europe for some considerable time to come.

Yet still the monetary madness continued, pushing bank deposit rates and bond yields deeper into negative territory. Unrecognisable evolving monetary conditions questioned the very sustainability of banking and insurance businesses in a negative yield, negative deposit rate environment. Such concerns prompted the outright sales of large portfolio holdings in Nordea Bank in Sweden and Zurich Financial in Switzerland.

Manipulative mischief in corporate bond markets and increasingly unreliable guidance over credit quality suggest an increasingly opaque outlook for European financials.

Watching from the side-lines how all this unravels seemed the safer and more prudent option. The widening financial and economic cracks that fractured further during the period arguably paled into insignificance when compared to the emerging political chasm that threatened the very existence of European unity.

For without doubt will go down in history as the year when the European political voice erupted in defiance of European establishment orthodoxy. At its core, unemployment, stagnant growth and broken promises; at its extremities, disillusionment with austerity, distrust of the ruling elite and discredited policies that failed to deliver.

In essence a disenfranchised electorate disproportionately enduring the associated deflationary pains. Fuelled by fear and paranoia, nationalist populism thrived. During the period exposure to European equities was significantly reduced to an historical low of Residual exposure remains defensively positioned towards pharmaceuticals and consumer staples companies with an overweight towards Switzerland.

Following on from Brexit, Europe faces an increasingly complex year ahead, fraught with political pitfalls: Elections in Germany, France and Netherlands; Britain's negotiated exit from the EU; Greece's simmering debt crisis and Italy's emerging bank crisis. All need to be resolved, managed and defused against an extremely challenging economic backdrop in which corporate profits and dividends remain under pressure.

Ordern e Progresso - Order and Progress. Such scripture circles the globe at the centre of Brazil's iconic green, blue and yellow flag. Without question these are commendable ideals but in practice they have seldom been adhered to. Brazilian economic, political and financial history is littered with periods of the exact opposite, but the most recent chapter, concluding with impeachment of disgraced President Dilma Rouseff, witnessed an end to her accident-prone term in office and offered encouraging signs of relief for one of Latin America's most conflicted nations.

Whilst hope followed by disappointment is arguably a particularly Brazilian cycle, recent developments could cautiously be viewed as progress. Emerging from its deepest recession since the s, the benefits of an extremely internationally competitive exchange rate soon became obvious. An expanding trade surplus attracted significant foreign direct investment inflows, the consequences of which translated into an appreciating currency and declining inflation.

Having endured three years of steadily rising interest rates such stability finally provided the platform to begin monetary easing. Against a backdrop of potentially accelerating interest rate cuts and renewed credit-sensitive growth, Brazilian financial markets performed very well.

Portfolio exposure to sovereign bonds, corporate bond and equities delivered significant capital and income returns in Sterling terms. With corporate profit and dividend upgrades likely to materialise, the current exposure will be maintained. Conversely, whilst Mexico shares few similarities with Brazil, as an inherently conservative nation, order and progress have essentially been delivered since the dark days of Mexico's own financial crisis over twenty years ago.

Recent developments proved no exception, but rising political tensions with the United States severely tested its resolve. Despite rising oil prices, buoyant consumer spending and competitive exports, the country remained suffocated by xenophobic electoral rhetoric in the United States.

The Central Bank hiked interest rates five times in defence of a fragile peso which in-enviably became the international barometer of protectionist sentiment. Unfortunately, it may be some time before it discards this unwelcome tag. Forex broker bangladesh decent returns from dollar-denominated Mexican bonds, equity exposure within the portfolio struggled to make progress.

Patience will be required, but solid corporate fundamentals support maintaining long term exposure. This was further enhanced by maturing Venezuelan sovereign bonds and Brazilian corporate bonds, which contributed significant capital and income gains. Given the possibility of further fundamental improvements sample earnest money agreement form predominately low consensus expectations, selective opportunities will continue to be pursued.

The review period witnessed the third anniversary of Japan's unorthodox monetary reflation plan. Introduced to universal enthusiasm and widespread acclaim, the new economic plan had been championed to deliver Japan prosperity from the depths of deflation. Thirty six months later, the economic consequences of an extraordinary monetary experiment which devalued the yen and inflated asset prices make sobering reading.

For those more interested in reality, what was high on ambition proved woefully short on substance. Declining real wages, higher sales taxes and more expensive imports condemned the average Japanese person's living standards to fall. Weak economic growth, faltering capital investment and sluggish corporate profitability restrained overall business conditions.

Most importantly, outright failure to resolve the Japanese deflationary mentality coupled with negative bond yields dictated for the first forex currency rates maybank ever, 95 free charts for binary options an aging demographic of Japanese savers watched helplessly as pension promises evaporated.

No economic textbook exists that can provide guidance for what comes next. Against this backdrop, it is never easy constructing an investment case.

Corporate Japan has no desire to raise dividends when competing long duration bond yields yield zero! The two companies currently owned have solid, double-digit, five year dividend growth histories, with strong balance sheets to suggest this can continue.

But with yields of around 3.

Looking forward, equity exposure can be maintained where bottom up business fundamentals are supportive, but the attractions remained severely limited. Macro-economic paralysis brought about by an aging population, insufficient immigration and constant financial market manipulation will not be alleviated until such times as Japan recognises its flawed policies and practices.

Such mea culpa is unlikely fnb forex botswana happen anytime soon.

Against any historical or relative yardstick this proved an exceptionally strong return. What is of interest on closer inspection behind headline numbers are the marked differences in performance which contributed to both total benchmark and total portfolio performance.

Better than expected growth, inflation and progress on fiscal reform fed through into currency strength in India and Indonesia forex exchange trading for beginners for further interest rate cuts and ongoing declines in bond yields. Portfolio returns from Indonesian and Indian bond exposures were very strong enhancing both capital and income.

No Can i make money selling kirby vacuums equity exposure due to prevailing high valuations and low dividend yields could be regarded as a missed opportunity, but only what is owned ultimately influences performance.

In this regard the large position in Unilever Indonesia contributed positively. Of materially greater significance were returns from exposures to Taiwan and Thailand. Taiwan Semiconductor and recently initiated Siam Commercial Bank proved standout performers in this respect. Further robust stock returns from Coca Cola Amatil, MTR Corp and Public Bank may not have matched the overall regional benchmark but that is not to criticise.

All contributed desired diversification across Australia, Hong Kong and Malaysia respectively and as such positively enhanced the investment objective. Both are relatively small growth companies well positioned to prosper from increasing consumer spending across the Asiatic region.

Both emphasise the strategy to invest in different companies in different businesses operating in different countries with different positive growth dynamics. In a global context, numerous such opportunities exist in Asia hence the portfolio's significant exposure there. Should future generations ever search for the seminal moment in economic history where so many supposedly intelligent people masquerading as Central Bankers and their financial market cheerleaders descended to the depths of discredited stupidity then 13 July will be as good as any.

For on this day Germany issued a ten year Bund with no coupon. An income investment with no income. To emphasise this particular hideous distortion from numerous others which have polluted financial markets over the past five years is not an attempt to rank its significance.

It serves only to highlight just how incredibly far the world has shifted from economic orthodoxy when savers expected, and were entitled to, a return on their savings.

The tangled web woven around spiralling debts, insolvent banks, unsustainable deficits, mis-allocated capital and erosion of real wealth exists only to distort and deceive. When such disrespect of real capital value exists, in what can we trust? It may appear disconcerting, but is no doubt worth repeating, against such a backdrop of unfamiliar extended valuations and deeply concerning fundamentals, there are no places to hide.

The bottom line, of which we are acutely aware, is that both bond and equity markets are very expensive on an absolute and relative basis. Portfolio diversification, through which exposures reflect preferred investment opportunities, does have the benefit of a european digital put option opportunity set.

For Murray International, the flexibility to invest anywhere in the world remains a powerful advantage. Trusting in tried and tested methods of stock and bond selection also brings a degree of familiarity to an unfamiliar world. Despite overall valuation concerns, it is still possible to differentiate between whether a business is cheap or expensive, whether it is quality or not.

With an emphasis, as ever, on capital preservation and maintaining dividends, diversification remains the strategy of preference, extreme caution the modus operandi. The Directors present their report and the audited financial statements for the year ended 31 December Details of the Company's results and proposed dividends are shown under Financial Highlights below. The Company is registered as a public limited company registered in Scotland No.

The Directors are of the opinion that the Company has conducted its affairs for the year ended 31 December so as to enable it to comply with the ongoing requirements for investment trust status. The Company has conducted its affairs so as to satisfy the requirements as a qualifying security for Individual Savings Accounts. The Directors intend that the Company will continue to conduct its affairs in this manner.

The Company's capital structure is summarised in note 15 to the financial statements. At 31 Decemberthere were , fully paid Ordinary shares of 25p each - , Ordinary shares in issue and no B Ordinary shares in issue -At the year end there were 1, Ordinary shares held in Treasury - nil. During the yearOrdinary shares were sold from Treasury all at a premium to the prevailing NAV per share - nil ; 28, new B Ordinary shares were issued by way of capitalisation issue in lieu of dividends - 45, ; and, 1, Ordinary shares were purchased in the market at a discount to NAV for Treasury - nil.

Ways of earning money as a teenager shareholders are entitled to vote on all resolutions which are proposed at general meetings of the Company. The Ordinary shares carry a right to receive dividends and on a winding up, after meeting the liabilities of the Company, the surplus assets will be paid to Ordinary shareholders in proportion to their shareholdings.

At the same time the Company repaid its Yen 1. The Company has appointed Aberdeen Fund Managers Limited "AFML"a wholly owned subsidiary of Aberdeen Asset How much money does a texas roughneck make PLC, as its alternative investment fund manager under the terms of an investment management agreement dated 14 July forex error 4109 Under the terms of the agreement, the Company's portfolio is managed by Aberdeen by way of a group delegation agreement in place between AFML and Aberdeen.

Investment management services are provided to the Company by AFML. Company secretarial, accounting and administrative services have been delegated by AFML to Aberdeen Asset Management PLC. With effect from 1 Januarythe Board and the Manager agreed a new basis for calculating the Company's management fees payable to AFML. The performance fee has been discontinued and the annual management fee is now charged on net assets ie excluding borrowings for investment purposes averaged over the six previous quarters "Net Assets"on a tiered basis.

The annual management fee is now charged at 0. Included in the charge of 0. A fee of 1. No fees are charged in the case of investments managed or advised by the Aberdeen Asset Management Group. The management agreement may now be terminated by either party on the expiry shorting the us stock market crashes on black tuesday six month's written notice.

On termination the Manager would be entitled to receive fees which would otherwise have been due up to that date. These changes to the management fee arrangements constituted a smaller related party transaction for the purpose of LR Prior to 1 January the management and secretarial fees payable to AFML had been calculated and charged on the basis of 0.

The Board considers the continued appointment of the Manager on the terms agreed to be in the interests of the shareholders as a whole because the Aberdeen Asset Management Group has the investment management, secretarial, promotional and administrative skills and expertise required for the effective operation of the Company.

The Board currently consists of six non-executive Directors. The names and biographies of the current Directors are disclosed in the Annual Report indicating their range of experience as well as length of service. In addition Lady Balfour of Burleigh served as a Director of the Company up to her retirement stock trading in india basics the Board on 26 April Making money while surfing the internet accordance with the Articles of Association, Mrs Mackesy, having been appointed on 1 Maywill retire and offer herself for re-election at the first AGM following her appointment.

The other Directors will also retire at the AGM in April and each Director will stand for re-election. The Board considers that there is a balance of skills and experience within the Board relevant to the leadership and direction of the Company and that all the Directors contribute effectively.

In common with most investment trusts, the Company has no employees. The Company's Articles of Association provide an indemnity to the Directors out of the assets of the Company against any liability incurred in defending proceedings or in connection with any application to the Court in which relief is granted. No Director has a service contract with the Company although Directors are issued with letters of appointment upon appointment.

The Directors' interests in contractual arrangements with the Company are as shown in note 21 to the financial statements. No other Directors had any interest in contracts shorting the us stock market crashes on black tuesday the Company during the period or subsequently.

The Board has a procedure in place to deal with a situation where a Director has a conflict of interest, as required by the Companies Act As part of this process, the Directors are required to disclose other positions held and all other conflict situations that may need to be authorised either in relation to the Director concerned or his or her connected persons.

The Board considers each Director's situation and decides whether to approve any conflict, taking into consideration what is in the best interests of the Company and whether the Director's ability to act in accordance with their wider duties is affected. Each Director is required to notify the Company Secretary of any potential currency converter euro to usd historical actual conflict situations that will need authorising by the Board.

Authorisations given by the Board are reviewed at each Board meeting. The Company has a policy of conducting its business in an honest and ethical manner. The Company takes sample earnest money agreement form zero tolerance approach to bribery and corruption and has procedures in place that are proportionate to the Company's circumstances to prevent them. The Manager also adopts a group-wide zero tolerance approach and has its own detailed policy and procedures in place to prevent bribery and corruption.

Copies of the Manager's anti-bribery and corruption policies are available on its website aberdeen-asset. There options futures and other derivatives download pdf been no significant changes notified in respect of the above holdings between 31 December and 10 March The Company is committed to high standards of corporate governance.

The Board is accountable to the Company's shareholders for good governance and, as required by the Listing Rules of the UK Listing Authority, has applied the principles identified in the UK Corporate Governance Code published in September and effective for financial years commencing put call fx options or after 1 October for the year ended 31 December The UK Corporate Governance Codes are available on the Financial Reporting Council's website: The Board has considered the principles and recommendations of the AIC Code of Corporate Governance as published in February AIC Code by reference to the AIC Corporate Governance Guide for Investment Companies AIC Guide.

The AIC Code, as explained by the AIC Guide, addresses all the principles set out in the UK Corporate Governance Code, as well as setting out additional principles and recommendations on issues which are of specific anzac day opening hours westfield doncaster to the Company.

Both the AIC Code and the AIC Guide are available on the Usd dollar rate in pakistan website: The Company has complied throughout the accounting period with the relevant provisions contained within the AIC Code and the relevant provisions of the UK Corporate Governance Code except as make that money robi robs clubworld out below.

The UK Corporate Governance Code includes provisions relating to: For the reasons set out in the AIC Code, and as explained in the UK Corporate Governance Code, the Board considers that these provisions are not relevant to the position of the Company, being an externally-managed investment company.

In particular, all of the Company's day-to-day management and administrative functions are outsourced to third parties. As a free binary option alerts, the Company has no executive directors, employees or internal operations.

The Company has therefore not reported further in respect of these provisions. The full text of the Company's Corporate Governance Statement can be found on the Company's website, murray-intl.

Directors have attended Board and Committee meetings during the year ended 31 December as follows with their eligibility to attend the relevant meeting in brackets: The terms of reference of all the Board Committees may be found on the Company's website murray-intl.

The terms of reference are reviewed and re-assessed by the Board for their adequacy on an annual basis. The MEC comprises all of the Directors. Dr Carter is the Chairman. The Committee reviews the performance of the Manager and its compliance with the terms of the management and secretarial agreement.

The terms and conditions of the Manager's appointment, including an evaluation of fees, are reviewed by the Committee on an annual basis. The Committee believes that the continuing appointment of the Manager on the terms that have been agreed is in the interests of shareholders as a whole. All appointments to the Board of Directors are considered by the Nomination Committee which comprises the entire Board and is chaired by Dr Carter.

The Board's overriding priority in appointing new Directors to the Board is to identify the candidate with the best range of skills and experience to complement existing Directors. The Board also recognises the benefits of diversity and its policy on diversity is referred to in the Strategic Report. When Board positions become available as a result of retirement or resignation, the Company ensures that a diverse group of candidates is considered.

During the year the Nomination Committee undertook a search for a new Director using the services of Korn Ferry, an independent specialist recruitment consultant. Having reviewed a long list and interviewed a short list of possible candidates Mrs Alexandra Mackesy was appointed to the Board on 1 May The Committee has put in place trading halt toronto stock exchange necessary procedures to conduct, on an annual basis, an appraisal of the Chairman of the Board, Directors' individual self evaluation and a performance evaluation of the Board as a whole.

The appraisal process concluded that the Board has a good balance of experience and knowledge of investment markets and continues to work in a collegiate and effective manner. The Board's policy on tenure is that Directors need not serve on copy trader forex malaysia Board for a limited period of time only. The Board does not consider that the length of service of a Director is as important as the contribution he or she has to make, and therefore the length of service will be determined on a case-by-case basis.

In accordance with Principle 3 of the AIC's Code of Corporate Governance which recommends that the directors of FTSE companies should be subject to annual re-election by shareholders, all the members of the Board will retire at the forthcoming Annual General Meeting and will offer themselves for re-election.

In conjunction with the evaluation feedback the Committee has reviewed each of the proposed reappointments and concluded that each of the Directors has the requisite high level and range of business and financial experience and recommends their re-election at the forthcoming AGM. The level of fees payable to Directors is considered by the Remuneration Committee which comprises the entire Board excluding Dr Carter and which is chaired by Mr Dunscombe.

The Company's remuneration policy is to set remuneration at a level to attract individuals of a calibre appropriate to the Company's future development.

Further information on remuneration is disclosed in realised and unrealised foreign exchange gains Directors' Remuneration Report. The D irectors have undertaken a robust review of the Company's viability refer to statement Strategic Report and ability to continue as a going concern.

The Company's assets consist of a diverse portfolio of listed equity shares and bonds. The equities and a majority of the bond portfolio are, in most circumstances, realisable within a very short timescale. The Directors are currently reviewing options to replace the facility. However, at this stage it is too early to confirm that the facility will be renewed.

If acceptable market online stock stock trading demo are available from dobra platforma forex existing bankers, or any alternative, the Company expects to continue overstock payment options access a similarly sized facility.

The Directors are mindful of the principal risks and uncertainties disclosed in the Remington 700 aftermarket stocks canada Report and have reviewed forecasts detailing revenue and liabilities.

The Directors believe that the Company has adequate financial resources to continue its operational existence for the foreseeable future and at least 12 months from the date of this Annual Report. Accordingly, the Directors continue to adopt the going concern basis in preparing these financial statements. Each Director confirms that, so far as he or she is aware, there is no relevant audit information of which the Company's auditor is unaware, and he or she has taken all the steps that they ought to have taken as a Stock market symbol for hallmark cards in order to make themselves aware of any relevant audit information and to establish that the Company's auditor is aware of that information.

The Company's policy is to conduct a regular review of its audit arrangements. EY, has expressed its willingness to continue in office and a Resolution to re-appoint EY as the Company's auditor will be put to the forthcoming Annual General Meeting, along with a separate Resolution to authorise the Directors to fix the auditor's remuneration. Details of fees relating to non-audit services are disclosed in the notes to the financial statements. The Directors have reviewed the level of non-audit services provided by the independent auditor during the year, together with the independent auditor's procedures in connection with the provision of such services, forex rate nzd usd remain satisfied that the auditor's objectivity and independence is being t r price emerging market stock fund. With effect from 1 January Deloitte has been appointed to provide local tax compliance services to the Company and EY has ceased to provide these tax services to the company.

Details of the financial risk management policies and objectives relative to the use of financial instruments by the Company are set out in note 18 to the financial statements.

The Board of Directors is ultimately responsible for the Company's system of internal control and for reviewing its effectiveness. Following the Financial Reporting Council's publication of "Guidance on Risk Management, Internal Controls and Related Financial and Business Reporting" the "FRC Guidance"the Directors confirm that there is an ongoing process for identifying, evaluating and managing the significant risks faced by the Company.

This process has been in place for the full year under review and up to the date of approval of the financial statements, and this process is regularly reviewed by the Board and accords with the relevant sections of the FRC Guidance. The design, implementation and maintenance of controls and procedures to safeguard the assets of the Company and to manage its affairs properly extends to operational and compliance controls and risk management.

The Board has prepared its own risk register which identifies potential risks relating to strategy, investment management, shareholders, marketing, gearing, regulatory and financial obligations; third party service providers and the Board. The Board considers the potential cause and possible impact of these risks as well as reviewing the controls in place to mitigate these potential risks.

A risk is rated by having a likelihood and bse stock market on monday morning impact rating and the residual risk is plotted on a "heat map" and is reviewed regularly.

The Board has reviewed the effectiveness of the system of internal control and, in particular, it has reviewed the process for identifying and evaluating the significant risks faced by the Company and the policies and procedures by which these risks are managed. The Directors have delegated the investment management of the Company's assets to AFML within overall guidelines and this embraces implementation of the system of internal control, including financial, operational and compliance controls and risk management.

Internal control systems are monitored and supported by AFML's internal audit function which undertakes periodic examination of business processes, including compliance with the terms of the management agreement, and ensures that recommendations to improve controls are implemented.

The Board has reviewed the effectiveness of the Aberdeen Group's system of internal control including its annual internal controls report prepared in accordance with the International Auditing and Assurance Standards Board's International Standard on Assurances Engagements "ISAE""Assurance Reports on Controls at a Service Organisation". The Board has also reviewed Aberdeen's process for identifying and evaluating the significant risks faced by the Company and the policies and procedures by which these risks are managed.

Risks are identified and forex trend scalper v1.1 through a risk management framework by each function within the Manager's activities. Risk is considered in the context of the FRC Guidance and includes financial, regulatory, market, operational and reputational risk.

This helps the Manager's internal audit risk assessment model to identify those functions for review. Any relevant currency rates in lahore pakistan identified through internal audit's review are reported to the Board and timetables are agreed for implementing improvements to systems, processes and controls.

The implementation of any remedial action required is monitored and feedback provided to the Board. The key components designed to provide effective internal control for the year under review and up to the date of this Report are outlined below: Reports on these issues, including performance statistics and investment valuations, are regularly submitted to the Board.

The Manager's investment process and financial analysis of the companies concerned include detailed appraisal and due diligence.

In addition, the Manager ensures that clearly documented contractual arrangements exist in respect of any activities that have been delegated to external professional organisations. The Board meets annually with representatives from BNY Mellon and reviews a control report covering the activities of the depositary and custodian. Representatives from the Internal Audit Department of the Manager report six monthly to the Audit Committee of the Company and have rex moneymaker access to the Directors at any time.

The internal control systems are designed to meet the Company's particular needs and the risks to which it is exposed. Accordingly, the internal control systems are designed to manage rather than eliminate the risk of failure to achieve business objectives and, by their nature, can provide reasonable but not absolute assurance against material misstatement or loss.

Discount Management Policy and Special Business at Annual General Meeting. At the Annual General Meeting held on 26 Aprilshareholders approved the renewal of the authority permitting the Company to repurchase its Ordinary shares. The Directors wish to renew the authority given by shareholders at the last Annual General Meeting.

The principal aim of a share buyback facility is to enhance shareholder value by acquiring shares at a discount to NAV, as and when the Directors consider this to be appropriate. The purchase of shares, when they are trading at a discount to NAV per share, should result in an increase in the NAV per share for the remaining shareholders.

This authority, if conferred, will only be exercised if to do so would result in an increase in the Corn futures market analysis per share for the remaining shareholders and if it is in the best interests of shareholders generally.

Any purchase of shares will be made within guidelines established from time to time by the Board. It is proposed to seek shareholder authority to renew this facility for another year at the Annual General Meeting.

The minimum price which may be paid is 25p per share. It is currently proposed that any purchase of shares by the Company will be made from the capital reserve of the Company. The purchase price will normally be paid out of the cash balances held by the Company from time to time. Special Resolution 15 will permit the Company to buy back shares and any shares bought back by the Company may be cancelled or held as Treasury shares.

The benefit of the ability to hold Treasury shares is that such shares may be resold. This should give the Company greater flexibility in managing its share capital and improve liquidity in its shares. The Company would only sell on Treasury shares at a premium to NAV. When shares are held in Treasury, all voting rights are suspended and no distribution either by way of dividend or secondary offering stock market for private companies way of a winding up is permitted in respect of Treasury shares.

If the Directors believe that there is no likelihood of re-selling shares bought back, such shares would be cancelled. Special Resolution 15 in the Notice of Annual General Meeting will renew the earnest money md to purchase in the market a maximum of Such authority will expire on the date of the Annual General Meeting or on 30 Junewhichever is earlier.

This means in effect that the authority will have to be renewed at the next Annual General Meeting or earlier if the authority has been exhausted. In terms of the Companies Act the "Act" the Directors may not allot shares unless so authorised by the shareholders.

Such authority will expire on the date of the next Annual General Meeting or on 30 Junewhichever is earlier. This means that the authority will have to be renewed at the next Annual General Meeting.

Money maker by the black keys mp3 shares are to be allotted for cash, Section of the Act provides that existing shareholders have pre-emption rights and that the new shares must be offered first to such shareholders in proportion to their existing holding of shares.

However, shareholders can, by special resolution, authorise the Directors to allot shares otherwise than by a pro rata issue to existing shareholders. This is the same nominal amount of share british pound australian dollar exchange rate forecast which the Directors are seeking the authority to allot pursuant to Resolution This authority will also expire on the date of the Annual General Meeting or on woodward livestock auction Junewhichever is earlier.

This authority will not be used in connection with a rights issue by the Company. The Directors intend to use the authority given by Resolutions 13 and 14 to allot shares and can i buy ipo stock on scottrade pre-emption rights only in circumstances where this will be clearly beneficial to shareholders as a whole.

Accordingly, issues will only be made where shares can be issued at a premium of 0. The issue proceeds will be available for investment in line with the Company's investment policy.

No issue of shares will be made which would effectively alter the control of the Company without the prior approval of shareholders in general meeting. Resolution 14 will also disapply pre-emption rights on the sale of Treasury shares as envisaged above. Once again, the pre-emption rights would only be disapplied where the Bullseye trading signals shares are sold at a premium to NAV of not less than 0.

The Directors consider that the authorities granted above are in the best interests of the shareholders taken as a whole and recommend that all shareholders vote in favour of the resolutions, as the Directors intend to in respect of their own beneficial holdings of Ordinary shares amounting in aggregate can i buy facebook stock through scottradeshares, representing approximately 0.

Responsibility for actively monitoring the activities of portfolio bollinger band trading strategies that work has been delegated by the Board to the AIFM which has sub-delegated that authority to the Manager.

The full text of the Company's response to the Stewardship Code may be found on the Company's website. The Directors place a great deal of importance on communication with shareholders. The Annual Report is widely distributed to other parties who have an interest in the Company's performance. Shareholders and investors may obtain up to date information on the Company through the Manager's freephone information service and the Company's website murray-intl.

The Company responds to letters from shareholders on a wide range of issues. The Board's policy is to communicate are binary options trades taxable in australia with shareholders and their representative bodies without the involvement of the Aberdeen Group either the Company Secretary or the Manager in situations where direct communication is required and usually a representative from the Board meets with major shareholders on an annual basis in order to gauge their views.

The Board corporation tax relief on unapproved share options aware of its duty to act in the interests of the Company. The Board acknowledges that there are risks associated with investment in companies which fail to conduct business in a socially responsible manner.

The Manager considers social, environmental and ethical factors which may affect the performance or value of the Company's investments. The Directors, through the Company's Manager, encourage companies in which investments are made to adhere to best practice in the area of Corporate Governance. They believe that this can best be achieved by entering into a dialogue with company management to encourage them, where necessary, to improve their policies in this area.

Total assets less current liabilities before deducting prior charges. Gearing ratio of borrowings less cash to shareholders' funds. With effect 30 second 60 profits binary options system 1 Januarythe performance fee was discontinued. Total return represents the capital return plus dividends reinvested. The Directors are responsible for preparing the Annual Report and the financial statements in accordance with applicable law and regulations.

Company law requires the Directors to prepare financial statements for each financial year. Under that law the Directors have elected to prepare the financial statements in accordance with United Kingdom Generally Accepted Accounting Practice United Kingdom Forex trading indicators pdf Standards and applicable law including FRS 'The Financial Reporting Standard applicable in the UK and Republic of Ireland'.

Under company law the Directors must not approve the financial statements song one day by trading yesterday chord they are satisfied that they give a true and fair view of the state of affairs of the Company and of the profit or loss of the Company for that period.

In preparing these financial statements, the Directors are required to: The Directors are responsible for keeping adequate accounting records that are sufficient to show and explain the Company's transactions and disclose with reasonable accuracy at any time the financial position of the Company and enable them to ensure that the financial statements comply with the Companies Act They are also responsible for safeguarding the assets of the Company and hence for taking reasonable steps for the prevention and detection of fraud and other irregularities.

Under applicable law and regulations, the Directors are also responsible for preparing a Directors' Report, Directors' Remuneration Report and Statement of Corporate Governance that comply with that law and those regulations. The financial statements are published on murray-intl. The Neutrogena coupon money maker are responsible for the maintenance and integrity of the corporate and financial information included on the Company's website.

Legislation in the UK governing the preparation and dissemination of financial statements may differ from legislation in other jurisdictions. Each of the Directors confirms that to the best of his or her knowledge: Return per Ordinary share with full conversion of B Ordinary shares pence.

The "Total" column of this statement represents the profit and loss account of the Company. There is no other comprehensive income and therefore the return on ordinary activities after taxation is also the total comprehensive income for the year.

The 'Revenue' and 'Capital' columns represent supplementary information prepared under guidance issued by the Association of Investment Companies. All revenue and capital items in the above statement derive from continuing operations. The accompanying notes are an integral part of these financial statements. The above dividend information does not form part of the Statement of Comprehensive Income.

Allotment and bonus issue of B Ordinary shares converted to Ordinary shares. The Company is a closed-end investment company, registered in Scotland No SC, with its Ordinary shares being listed on the London Stock Exchange. The financial statements have been prepared in accordance with Financial Reporting Standard and with the AIC's Statement of Recommended Practice 'Financial Statements of Investment Trust Companies and Venture Capital Trusts'. They have also been prepared on a going concern basis and on the assumption that approval as an investment trust will continue to be granted.

Dividends receivable on equity shares are treated as revenue for the year on an ex-dividend basis. Where no ex-dividend date is available dividends are recognised on their due date. Provision is made for any dividends not expected to be received. Special dividends are credited to capital or revenue, according to their circumstances. In some jurisdictions, investment income and capital gains are subject to withholding tax deducted at the source of the income.

The Company presents the withholding tax separately from the gross investment income in the Statement of Comprehensive Income under taxation. The fixed returns on debt securities are recognised on a time apportionment basis so as to reflect the effective yield on the debt securities. Interest receivable from cash and short-term deposits is accrued to the end of the year.

All expenses are accounted for on an accruals basis and are charged to the Statement of Comprehensive Income. Expenses are charged against revenue except as follows: The tax expense represents the sum of tax currently payable and deferred tax. Any tax payable is based on the taxable profit for the year. Taxable profit differs from net profit as reported in the Statement of Comprehensive Income because it excludes items of income or expense that are taxable or deductible in other years and it further excludes items that are never taxable or deductible.

The Company's liability for current tax is calculated using tax rates that were applicable at the Statement of Financial Position date. Deferred taxation is recognised in respect of all timing differences that have originated but not reversed at the Statement of Financial Position date, where transactions or events that result in an obligation to pay more tax in the future or right to pay less tax in the future have occurred at the Statement of Financial Position date.

This is subject to deferred tax assets only being recognised if it is considered more likely than not that there will be suitable profits from which the future reversal of the underlying timing differences can be deducted. Timing differences are differences arising between the Company's taxable profits and its results as stated in the financial statements which are capable of reversal in one or more subsequent periods.

Deferred tax is measured on a non-discounted basis at the tax rates that are expected to apply in the periods in which timing differences are expected to reverse, based on tax rates and laws enacted or substantively enacted at the Statement of Financial Position date.

Due to the Company's status as an investment trust company and the intention to continue meeting the conditions required to obtain approval in the foreseeable future, the Company has not provided deferred tax on any capital gains and losses arising on the revaluation or disposal of investments.