Covered put options payoff diagrams

Covered Call and Protective Put Strategies There is one more way for options to be classified: Whether a contract is covered or uncovered has a great deal to do with the margin, or credit, required of the parties involved.

Covered Call A covered call is when the investor has a long position in an asset combined with a short position in a call option on the same underlying asset. A call writer may be required to deliver the stock if the buyer exercises his option.

If the call writer has the shares on deposit with her broker, then she has written a covered call. There is no margin requirement for a covered call; this is because the underlying securities are sitting right there - there is no question of creditworthiness. An investor will write a call option when he feels that a particular stock's price will not rise above a certain level. Note that if the call option is exercised in the money, the call writer will sell the call option holder's stock from his inventory at the strike price indicated in the option contract.

His maximum loss would then be: Let's look at an example. The following diagram illustrates the typical payoff to expect from a covered call. Uncovered Call If the call writer does not have the underlying shares on deposit, she has written an uncovered call, which is much riskier for the writer than a covered call. If the buyer of a call exercises the option to call, the writer will be forced to buy the asset at the spot price and, since there is no limit to how high a share price can go, that spot price can theoretically go up to an infinite amount of dollars.

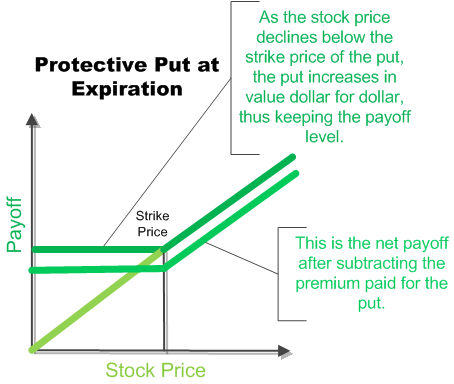

Protective Put A protective put is an option in which the writer has cash on deposit equal to the cost to purchase the shares from the holder of the put if the holder exercises his right to sell. This limits the writer's risk because money or stock is already set aside. The risk, however, is not that great.

The stock is not going to be purchased at the spot price; it is going to be purchased at the exercise price, which was agreed to the day of the opening transaction. The higher the spot price goes, the more the writer benefits because she buys the stock at the lower exercise price and sells it for whatever she can get in the market.

Let's consider the worst-case scenario in which the writer has to pay the full exercise price for a completely worthless stock. Nobody wants to lose that kind of money, but it is insignificant compared to the astronomical losses possible with writing uncovered calls.

An uncovered put is a short position in which the writer does not have cash on deposit equal to the cost to purchase the shares from the holder of the put if the holder exercises his right to sell. Again, the writer knows, to the dollar, exactly what the worst-case scenario is and can make an informed decision about whether or not it is worth tying up capital to cover the put.

Dictionary Term Of The Day. A measure of what it costs an investment company to operate a mutual fund. Latest Videos PeerStreet Offers New Way to Bet on Housing New to Buying Bitcoin? This Mistake Could Cost You Guides Stock Basics Economics Basics Options Basics Exam Prep Series 7 Exam CFA Level 1 Series 65 Exam. Sophisticated content for financial advisors around investment strategies, industry trends, and advisor education. Managing Risk with Options Strategies: Covered Calls and Protective Puts By Investopedia Share.

Chapter 1 - 5 Chapter 6 - 10 Chapter 11 - 15 Chapter 16 - Ethics and Standards 2. Global Economic Analysis 1. Knowledge of the Law 1.

Covered Put Explained | Online Option Trading Guide

Independence And Objectivity 1. Material Nonpublic Information 1. Loyalty, Prudence And Care 1. Preservation Of Confidentiality 1. Duties to Employers, Standard IV-A: Additional Compensation Arrangements 1. Responsibilities Of Supervisors 1. Diligence And Reasonable Basis 1. Communication With Clients And Prospective Clients 1. Disclosure Of Conflicts 1.

Managing Risk with Options Strategies: Covered Calls and Protective Puts

Priority Of Transaction 1. Composites And Verification 1.

Put payoff diagram (video) | Khan Academy

Disclosure And Scope 1. Requirements And Recommendations 1. Fundamentals Of Compliance And Conclusion 2. Real GDP, and the GDP Deflator 4. Pegged Exchange Rate Systems 5. Fixed Income Investments The Tradeoff Theory of Leverage The Business Cycle The Industry Life Cycle Intramarket Sector Spreads Calls and Puts American Options and Moneyness Long and Short Call and Put Positions Covered Calls and Protective Puts.

Covered Uncovered, or naked Whether a contract is covered or uncovered has a great deal to do with the margin, or credit, required of the parties involved. Learn the top three risks and how they can affect you on either side of an options trade. The adage "know thyself"--and thy risk tolerance, thy underlying, and thy markets--applies to options trading if you want it to do it profitably.

Covered calls may require more attention than bonds or mutual funds, but the payoffs can be worth the trouble. Learn how to buy calls and then sell or exercise them to earn a profit. A brief overview of how to provide from using call options in your portfolio.

Learn how this simple options contract can work for you, even when your stock isn't. Options offer alternative strategies for investors to profit from trading underlying securities, provided the beginner understands the pros and cons.

The strategy of writing covered calls on ETFs can limit your losses and hedge risk, but they cap your upside potential. Beginning traders often ask not when they should buy options, but rather, when they should sell them. A brief overview of how to profit from using put options in your portfolio. Traditionally, historical quotes on stocks and indexes were hard to come by for the general public, but this is no longer You may participate in both a b and a k plan.

However, certain restrictions may apply to the amount you can Generally speaking, the designation of beneficiary form dictates who receives the assets from the individual retirement Content Library Articles Terms Videos Guides Slideshows FAQs Calculators Chart Advisor Stock Analysis Stock Simulator FXtrader Exam Prep Quizzer Net Worth Calculator. Work With Investopedia About Us Advertise With Us Write For Us Contact Us Careers.

Get Free Newsletters Newsletters. All Rights Reserved Terms Of Use Privacy Policy.