Harmonic trading forex

Chart Pattern recognition is the basic and primary ability any trader develops in Technical Analysis. It may be basic development, but the perfection of pattern recognition takes extensive practice and repetitive exposure.

The expert recognition of patterns helps traders to quantify and react to the changing market environment.

Free Harmonic Indicators for Metatrader 4

The complex patterns structures may consist of collections of simple patterns and combination of prior swings. The knowledge of this classification of pattern recognition and its properties give traders greater potential to react and adapt to a wider range of trading conditions.

Market prices always exhibit trend, consolidation and re-trend behavior. They rarely reverse their trends and transitional phases to turn from a previous trend on a single bar. During this transitional phase, they experience trading ranges and price fluctuations. This ranging action defines identifiable price patterns. These consolidation phases occasionally favor prevailing trends prior to their formation and continue their direction. Symmetric Triangle, Flags and Cup and Handle. Some phases result in reversing the prior trend and continue in reversal conditions.

Head and Shoulders, Double Bottoms and Broadening Patterns. Harmonic Patterns foundation and trading concepts were laid by H. Gartley wrote about a 5-point pattern known as Gartley in his book, Profits in the Stock Market.

His pioneering work is truly impressive and the trading world should thank him immensely as he has opened newer trading styles and careers for many traders. Fibonacci ratio analysis works well with any markets and on any time-frame charts. The basic idea of using these ratios is to identify key turning points, retracements, and extensions along with a series of the swing high and the swing low points.

The derived projections and retracements using these swing points Highs and Lows will give key price levels for Targets or Stops. These harmonic structures identified as specified Harmonic patterns provide unique opportunities for traders with potential price movements and key turning or trend reversal points. This factor adds an edge for traders as Harmonic patterns attempt to provide highly trustful price entries, stops and targets information.

A 5-point pattern Gartley Bullish is shown below. These patterns resemble 'M' or 'W' patterns with 5 key pivot points define the harmonic pattern Gartley. Gartley patterns built by 2 retracement legs and 2 impulse swings legs forming a 5-point pattern and all these swings are inter-related and associated with Fibonacci ratios. The center eye of the pattern is 'B' defines the pattern and 'D' is the action or trigger point where trades are taken.

It shows trade entry Long , stop and target levels from 'D' level. The following chart shows another 5-point Harmonic pattern Butterfly Bearish. This pattern is similar to the above 5-point Gartley pattern, but in reverse.

Here the pattern is 'W' shaped with 'B' being the center eye of the pattern. It shows trade entry, stop and target levels from 'D' levels using 'XA' leg. Harmonic patterns discussion must include Fibonacci numbers as harmonic patterns use Fibonacci ratios extensively. Fibonacci numbers are pervasive in the universe and were originally derived by Leonardo Fibonacci. Fibonacci Numbers are a sequence of numbers where each number is the sum of the previous two numbers.

There are plenty of materials and books about the theory of how these numbers exist in nature and in the financial world. A list of the most important Fib ratios in the financial world which are derived by squaring, square-roots and reciprocating the actual Fibonacci Numbers are depicted below:.

Key Set of Fibonacci Derived Ratios in Trading are: Secondary Set of Fibonacci Derived Ratios in Trading are: There are many applications of Fibonacci in Technical Analysis. Some of the applications include Fibonacci retracements, Fibonacci projections, Fibonacci Fans, Fibonacci Arcs, Fibonacci Time Zones, Fibonacci Price and Time Clusters etc.

Most trading software packages have Fibonacci drawing tools which can show Fib retracements, Fib Extensions, and Fib Projections. In the following graphic, Types of Fibonacci are shown to depict how retracement, extension, projection and expansion swings are applied using Fibonacci ratios.

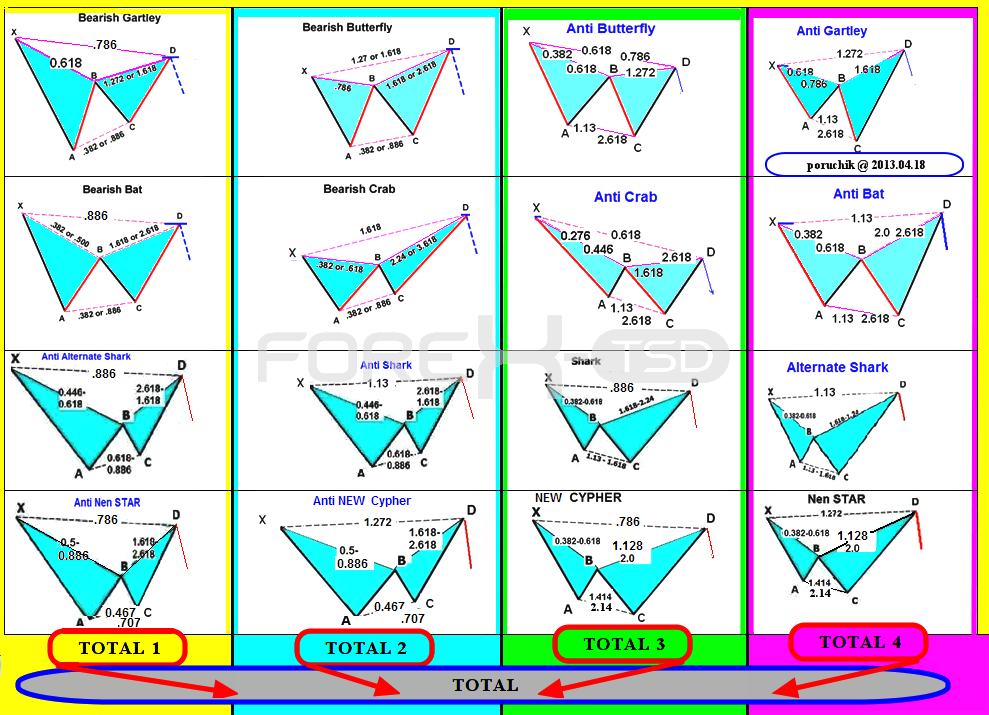

Harmonic pattern identification can be bit hard with the naked eye, but once a trader understands the pattern structure it can be relatively easily spotted by Fibonacci tools. The primary Harmonic patterns are 5-point Gartley, Butterfly, Crab, Bat, Shark and Cypher patterns. These patterns have embedded 3-point ABC , 4-Point ABCD patterns. All the price swings between these points are inter-related and have harmonic ratios based on Fibonacci.

Patterns are either forming or completed 'M' or 'W' shaped structures or combinations of 'M' and 'W', in the case of 3-drives. Harmonic patterns 5-point have a critical origin X followed by an impulse wave XA followed by a corrective wave to form the 'EYE' at B completing AB leg.

Harmonic Trading Patterns From Scott M. Carney Explained in Detail

Then followed by a trend wave BC and finally completed by a corrective leg CD. The critical harmonic ratios between these legs determine whether a pattern is a retracement based or extension based pattern and defines its names Gartley, Butterfly, Crab, Bat, Shark and Cypher.

One of the significant point to remember is: All 5-point and 4-point Harmonic patterns have embedded ABC 3-Point patterns. All 5-point Harmonic patterns Gartley, Butterfly, Crab, Bat, Shark, Cypher have similar principles and structures, and they differ by their ratios to identify them and locations of key nodes X, A, B, C, D but once one of the patterns is understood it may be relatively easy to grasp knowledge of others.

It may help for traders to use an automated pattern recognition software to identify these patterns than using naked eye to find or force these pattern identification. The following chart shows an example of Bullish Bat pattern with embedded ABC Bearish pattern.

The identification pivots and ratios are marked on the pattern. The pattern also shows the Entry, Stop and Target levels. In harmonic pattern setups, a trade is identified when the first 3 legs are completed in 5-point patterns. For example, in Gartley Bullish pattern, when XA, AB, BC legs are completed and it starts to form CD leg, you would identify the potential trade may be in works.

Using the projections and retracements of XA, BC legs and Fibonacci ratios we build a price cluster to identify potential Price completion zone PCZ and D point of the pattern. All Harmonic patterns have defined Pattern Completion Zones PCZ. These PCZs are also known as price clusters formed by the completed swing legs confluence of Fibonacci extensions, retracements and price projections.

Pattern supposed to complete its CD leg also complete D in this zone PCZ and reverse. Trades are anticipated in this zone and entered on price reversal action. As an example, Pattern Completion Zone PCZ for Bullish Gartley pattern is constructed using following Fibonacci extensions and projections:. Most technical traders use chart analysis with market context concepts to trade. Each trader develops his own market context to trade. One of the elegant ways to define market context is through a Fib.

Grid consists of Fib. All these patterns are well explained in my book with clear examples. On any trading chart, Fib. Grid layout is plotted to understand how the current price is reacting to the Fib. The Confluence of these levels in the Fib.

When combined Harmonic Pattern analysis with market context gives a great edge to trade. Harmonic Patterns also fail but their failure levels are well defined and that information is clearly known prior to the trade. Hence, Harmonic pattern trading has much more advantage than trading other trading methods. Divergence, Multiple Time-Frames, Fib. Bands, Andrew's Pitchfork Analysis, Moving Averages, Pivots, Channels, Trendlines, Volume, Volatility etc.

The following example shows how Market Context is used with pattern analysis. This example shows AAPL date: Bands A, C points and D point is formed near lower Fib. Bands with Crab pattern.

Also, notice the pattern traded below mid-Fib. Band level and trading near lower Fib. Band to signal a potential exhaustion setup. After completing Bullish Crab setup, price traded above the EL to signal a Long entry to the setup.

The overall trend of APPL is also Bullish as price slope is positive above SMA. Target levels are The following chart June 9, shows APPL Bullish Crab pattern progression and completion of targets. Trading Harmonic patterns with computed entry levels are this author's preference rather than trading them blindly at retracement levels or reversal zones advocated by Harmonic trading pundits.

Most Harmonic Pattern trade entries occur around 'D' point within the reversal zone. It could be a Buy in bullish patterns or a Sell in bearish patterns. The entry criteria and pattern validity are determined by various other factors like current volatility, underlying trend, volume structure within the pattern and market internals etc. If the pattern is valid and the underlying trend and market internals agreeing with the Harmonic pattern reversal, then Entry levels EL can be calculated using price-ranges, volatility or some combination.

For example, in Gartley bullish pattern, the target zones are computed using XA leg from the trade action point D. The projections are computed using Fib. The extension ratios like 1. It is important to note that potential target zones in harmonic patterns are computed from probability standpoint and not from the certainty. Strong money and risk management rules and full working knowledge of the pattern are necessary for any pattern trading success.

5 reasons why Harmonic Trading will be the most used trading methodology by | HarmonicForex

The following chart shows a Bullish Gartley Pattern, entry level, stops and target zones. The Target zones are projected using XA swing length and Fibonacci ratios from D. This article was written by Suri Duddella, a private trader who uses proprietary mathematical and algorithmic models and pattern recognition methods. For more information about Suri or to follow his work, visit SuriNotes. Market data provided by: Commodity and historical index data provided by: Unless otherwise indicated, all data is delayed by 20 minutes.

The information provided by StockCharts. Trading and investing in financial markets involves risk. You are responsible for your own investment decisions. Log In Sign Up Help. Free Charts ChartSchool Blogs Webinars Members. Table of Contents Trading Harmonic Patterns. Examples of Harmonic Patterns A 5-point pattern Gartley Bullish is shown below. The series of Fib Numbers begin as follows: A list of the most important Fib ratios in the financial world which are derived by squaring, square-roots and reciprocating the actual Fibonacci Numbers are depicted below: Harmonic Patterns provide future price projections, stops in advance.

This makes them leading indicators.

Harmonic Patterns are frequent, repeatable, reliable and do produce high probable setups. The trading rules are relatively standardized Credit: Scott Carney and Larry Pesavento using Fibonacci ratios. Pattern Identification Harmonic pattern identification can be bit hard with the naked eye, but once a trader understands the pattern structure it can be relatively easily spotted by Fibonacci tools.

Trade Identification In harmonic pattern setups, a trade is identified when the first 3 legs are completed in 5-point patterns. Pattern Completion Zone PCZ All Harmonic patterns have defined Pattern Completion Zones PCZ. As an example, Pattern Completion Zone PCZ for Bullish Gartley pattern is constructed using following Fibonacci extensions and projections: Here is an example of Potential Completion Zone PCZ formation: Market Context Conditions Most technical traders use chart analysis with market context concepts to trade.

Trade Entries and Stops Trading Harmonic patterns with computed entry levels are this author's preference rather than trading them blindly at retracement levels or reversal zones advocated by Harmonic trading pundits. Sign up for our FREE twice-monthly ChartWatchers Newsletter! Blogs Art's Charts ChartWatchers DecisionPoint Don't Ignore This Chart The Canadian Technician The Traders Journal Trading Places.

More Resources FAQ Support Center Webinars The StockCharts Store Members Site Map. Terms of Service Privacy Statement.