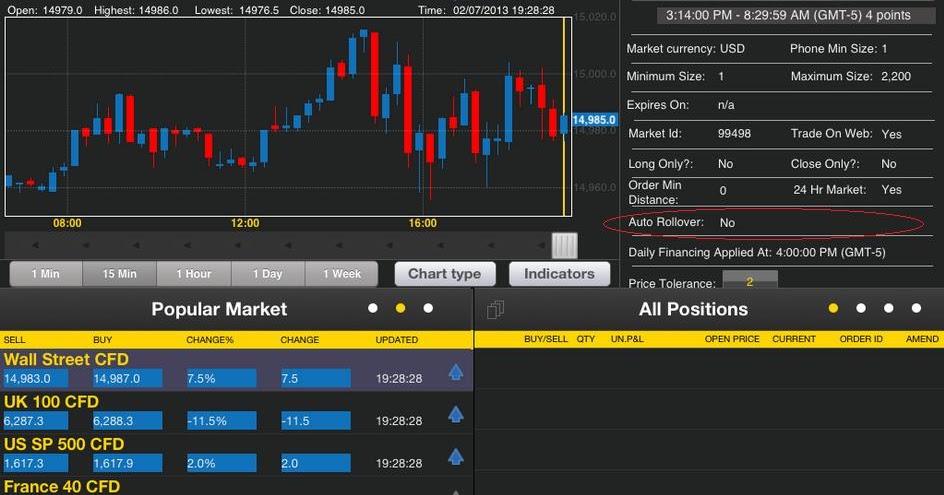

Rollover stock market

Rollover is unique to each product, and it produces a substantial impact upon volatility and price action within the marketplace.

The full attention of investors engaged in trading expiring contracts is required, as unique challenges are presented via split volume and reduced market liquidity. Rollover is a key aspect of futures trading that must be accounted for, as it directly impacts the bottom line of the trading account.

Futures contracts are financial products priced according to the value of a specific quantity of an underlying asset over a fixed period of time.

Because a futures contract is finite in duration, there are a few key dates that active traders need to be aware of:. The roll date is not a scheduled date; it represents the time in which the process of rollover typically commences. Expiration and last trading day are the exact dates in which a contract becomes invalid for trade and all positions in a given contract are closed. During the days surrounding the roll date, trading volumes tend to become split between the expiring contract and contracts expiring further in the future.

The split in volume can have a substantial impact upon short-term liquidity and render difficult intraday trading conditions. The period surrounding contract rollover in a specific futures market can be a challenging time for traders. Decreasing volume due to attention being shifted to other futures contracts poses several potential hazards, and many professional traders avoid rollover altogether.

Read more about rollover in forex. Leverage can work against you. Be aware and fully understand all risks associated with the market and trading. Prior to trading any products offered by Forex Capital Markets Limited , inclusive of all EU branches, FXCM Australia Pty. Limited , any affiliates of aforementioned firms, or other firms within the FXCM group of companies [collectively the "FXCM Group"], carefully consider your financial situation and experience level. If you decide to trade products offered by FXCM Australia Pty.

Limited "FXCM AU" AFSL , you must read and understand the Financial Services Guide , Product Disclosure Statement , and Terms of Business.

4 Reasons The Stock Market Might Roll Over In | Kitco News

The FXCM Group may provide general commentary which is not intended as investment advice and must not be construed as such. Seek advice from a separate financial advisor. The FXCM Group assumes no liability for errors, inaccuracies or omissions; does not warrant the accuracy, completeness of information, text, graphics, links or other items contained within these materials.

The FXCM Group is headquartered at 55 Water Street, 50th Floor, New York, NY USA. Forex Capital Markets Limited "FXCM LTD" is authorised and regulated in the UK by the Financial Conduct Authority. Registered in England and Wales with Companies House company number Limited "FXCM AU" is regulated by the Australian Securities and Investments Commission, AFSL FXCM Markets Limited "FXCM Markets" is an operating subsidiary within the FXCM Group.

FXCM Markets is not regulated and not subject to the regulatory oversight that govern other FXCM Group entities, which includes but is not limited to, Financial Conduct Authority, and the Australian Securities and Investments Commission.

FXCM Global Services, LLC is an operating subsidiary within the FXCM Group. FXCM Global Services, LLC is not regulated and not subject to regulatory oversight. Market Insights Currency Markets Commodities Trading Glossary.

What Is Rollover In Futures Trading? Expiration And Roll Date Futures contracts are financial products priced according to the value of a specific quantity of an underlying asset over a fixed period of time. Because a futures contract is finite in duration, there are a few key dates that active traders need to be aware of: The last day that a futures contract is binding.

Rollover Definition | What Does Rollover Mean | IG UK

After expiration, a futures contract is no longer valid. The last day when a futures contract can be traded. After the last trading day, delivery of the underlying asset or cash settlement must transpire. Volume Splits And Liquidity During the days surrounding the roll date, trading volumes tend to become split between the expiring contract and contracts expiring further in the future. The result of decreased volume has two effects upon the market: As the number of market participants decreases, the spread between buyers and sellers gets larger.

In turn, entering and exiting the market becomes a more costly proposition.

A decrease in the number of buyers and sellers placing market orders at each price reduces market liquidity and greatly increases the chance of experiencing substantial slippage upon market entry and exit. How To Make Money In The Stock Market. What Is The Difference Between Forex And Futures? What Is Rollover In Forex?

Going Public Experts

FXCM Financials Regulation Code of Conduct. Past Performance is not an indicator of future results. Retrieved 22 June http: