What is plain vanilla currency option

A currency option is a type of foreign exchange derivative contract that confers to its holder the right, but not the obligation, to engage in a forex transaction.

To learn more about forex trading, visit forex for dummies here. In general, buying such an option will allow a trader or hedger to elect to purchase one currency against another in a specified amount by or on a specified date for an up front cost. Some of the more common option related terms are defined below:. The price of currency options are determined by its basic specifications of strike price, expiration date, style and whether it is a call or put on which currencies.

Option market makers estimate this key pricing factor and usually express it in percentage terms, buying options when volatility is low and selling options when volatility is high.

When trading currency options, you first need to keep in mind that time really is money and that every day you own an option will probably cost you in terms of time decay.

Product Descriptions and FAQs

Furthermore, this time decay is larger and hence presents more of an issue with short dated options than with long dated options. The triangle was also forming over several weeks, with a well defined internal wave structure that gives the trader considerable certainty that a breakout is imminent, although they are not sure in what direction it will occur.

Currency options have enjoyed a growing reputation as helpful tools for hedgers to manage or insure against foreign exchange risk. For example, a U. In terms of a simple currency hedging strategy using options, consider the situation of a mining goods exporter in Australia that has an anticipated, although not yet certain, shipment of mining products intended to be sent for further refinement to the United States where they will be sold for U.

Dollar put option in the amount of the anticipated value of that shipment for which they would then pay a premium in advance. Alternatively, to save on the cost of premium, the exporter could only buy an option out to when any uncertainty about the shipment and its destination was likely to be removed and its size was expected to become virtually assured.

In this case, they could then replace the option with a forward contract to sell U. Dollars and buy Australian dollars in the now-known size of the deal.

Forex options also make a useful speculative vehicle for institutional strategic traders to obtain interesting profit and loss profiles, especially when trading on medium term market views. Even personal forex traders dealing in smaller sizes can trade currency options on futures exchanges like the Chicago IMM, as well as through some retail forex brokerages. This is similar to a binary or digital exotic currency option.

Such options are also often known as plain vanilla or just vanilla currency options to distinguish them from the more exotic option varieties covered in a later section of this course.

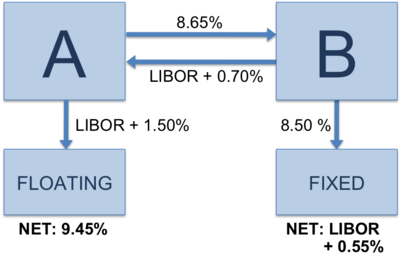

Plain Vanilla Swap

The most common style traded in the Over-the-Counter or OTC forex market is the European-Style option. This style of option can only be exercised on its expiration date up to a certain specific cutoff time, usually 3pm Tokyo, London or New York time. Nevertheless, the most common style for options on currency futures, such as those traded on the Chicago IMM exchange, is known as American style.

This style of option can be exercised at any time up to and including its expiration date. Nevertheless, the early exercise of American Style options usually only makes sense for deep in the money call options on the high interest rate currency, and selling the option instead will usually be the better choice in most cases.

A strategy on how to use currency options expiries for forex trading. See a short description of many more forex trading derivatives, as well as variants of currency options.

Trading Foreign Exchange on margin carries a high level of risk and may not be suitable for all investors. The possibility exists that you could lose more than your initial deposit. The high degree of leverage can work against you as well as for you.

OptiLab Partners AB Fatburs Brunnsgata 31 28 Stockholm Sweden Email: You are using an outdated browser. Please upgrade your browser to improve your experience. World's best forex deals and strategy. Some of the more common option related terms are defined below: Expiration Date — The last date upon which the option can be exercised. Delivery Date — The date upon when the currencies will be exchanged if the option is exercised.

umypecodayok.web.fc2.com: Terms starting with P

Call Option — Confers the right to buy a currency. Put Option — Confers the right to sell a currency.

Premium — The up front cost involved in purchasing an option. Strike Price — The rate at which the currencies will be exchanged if the option is exercised. Currency Option Pricing Factors The price of currency options are determined by its basic specifications of strike price, expiration date, style and whether it is a call or put on which currencies. Specifically, these market driven parameters are: Currency Option Trading Example When trading currency options, you first need to keep in mind that time really is money and that every day you own an option will probably cost you in terms of time decay.

Uses of Currency Options Currency options have enjoyed a growing reputation as helpful tools for hedgers to manage or insure against foreign exchange risk.

Currency Option Hedging Example In terms of a simple currency hedging strategy using options, consider the situation of a mining goods exporter in Australia that has an anticipated, although not yet certain, shipment of mining products intended to be sent for further refinement to the United States where they will be sold for U.

More uses of currency options Forex options also make a useful speculative vehicle for institutional strategic traders to obtain interesting profit and loss profiles, especially when trading on medium term market views. Forex fundamental analysis A strategy on how to use currency options expiries for forex trading. Sign Up Free Demo.