Japanese candlesticks tutorial

Japanese Candle Sticks are the sign language of the markets and understanding terms like morning star candlestick and hanging man candlestick can be an invaluable skill for your trading arsenal. Whether you trade crypto, stocks, heating oil, gold or currency, learning to "listen" and understand what the candles are "saying" will give you a powerful edge in your trading. Created by the Japanese sometime during the 's, candle sticks where used to analyze the price of rice contracts.

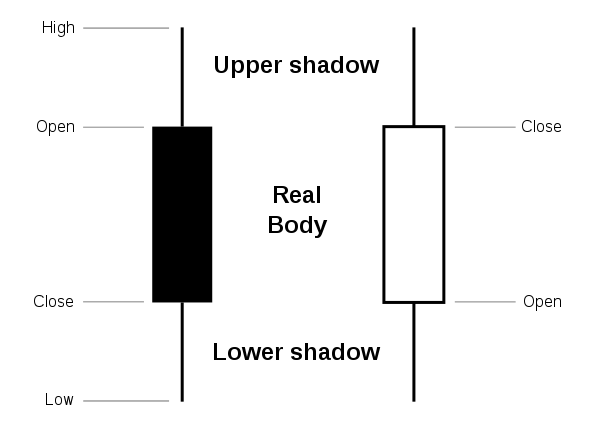

Japanese candle sticks animate what are otherwise technical price records by painting a colorful picture thus creating a visual representation of price history.

They are constantly telling a story and the day you are able to effectively read them is the day your trading will improve dramatically. If you are looking at a one hour chart then each candle represents the price activity for one hour.

If you are looking at a day chart then each candle would represent one day and so on. This tells us prices where going UP while that candle was open.

Introduction to Candlesticks [ChartSchool]

Sometimes bullish candles will be green on the chart. This tells us there was japanese candlesticks tutorial sellers than buyers while this candle was open so the price fell. If the high is also the close, there will be no upper wick as is the case with the blue bullish candle above. Full bodied candles are considered "decision" candles, a decision candle tells us the market has made a decision to go in a particular direction.

Japanese Candlestick Charts Tutorial

Indecision candles are candles with little or no body at all. These candles tell us the market cannot make up its mind which direction it wants to go.

Look at the picture above. Note a que horas abren el mercado forex left hand red bearish candle opened and while the candle was open, prices continued to fall producing a long red body.

This is a decision candle. The japanese candlesticks tutorial knew where it was going and that direction was down. During the life of the next candle the direction was not a sure.

Notice the smaller body and the small upper wick. The next candle often referred to as a "Doji," is the grand daddy of indecisive candles.

Notice how price climbed up and fell way down before closing just about the same place it opened? Dojis usually have long wicks on both sides and a very little or no body at all.

This post was adapted from some chart reading tutorials I created for one of my Forex websites. Used in conjunction with other trading tools like support and resistance, Fibonacci levels and chart patterns, candlesticks can help offer additional insight into the mood of the market you are trading.

If there's enough interest in this, the next tutorial will look at some popular candlestick patterns. Sign Up Login Submit a Story pencil2. Crypto Trading Tutorial - How to read Japanese candlesticks 23 hours ago. Authors get paid when people like you upvote their post.

Join our amazing community to comment and reward others. Sign up now to receive FREE STEEM!