Book value of equity vs market value

October 7, By Surbhi S Leave a Comment. Market value of an asset represents the actual market price of the asset, that is traded in the market place. It can also be understood as the actual worth of the firm relating to other firms in the marketplace.

Bailout 3: Book value vs. market valueBook Value, as the name signifies, is the value of the commercial instrument or asset, as entered in the financial books of the firm. On the other hand, Market Value is defined as the amount at which something can be bought or sold on a given market. People find it a bit difficult to identify, which one will prove the best for an investor to consider before investing his money in the company.

These two values may vary, or they may be same but above all, you must know that the difference between book value and market value will show you the profit or loss.

What's the difference between book and market value?

Conversely, if the values tally then there would be no profit no loss. Basis for Comparison Book Value Market Value Meaning Book Value means the value recorded in the books of the firm for any asset.

Market Value is that maximum price at which an asset or security can be sold in the market. It is the actual worth of the asset or company.

It is a the highest estimated value of the asset or company. Reflects Firm's equity Current market price Frequency of Fluctuations Infrequent, i. Tangible and intangible assets, which the company possesses. Readily Available Yes No. Book Value, for assets, is the value that is shown by the Balance Sheet of the company.

As per generally accepted accounting principles, the asset should be recorded at their historical cost less accumulated depreciation.

In the case of a company, the book value represents its net worth. It is the amount which will remain with the company if it gets liquidated immediately.

Such an amount is expected to be distributed among the numerous shareholders. Market Value is described as the maximum amount that a buyer is ready to pay for an asset in a competitive market is known as Market Value. It is the value at which the trading of the asset is done in the marketplace.

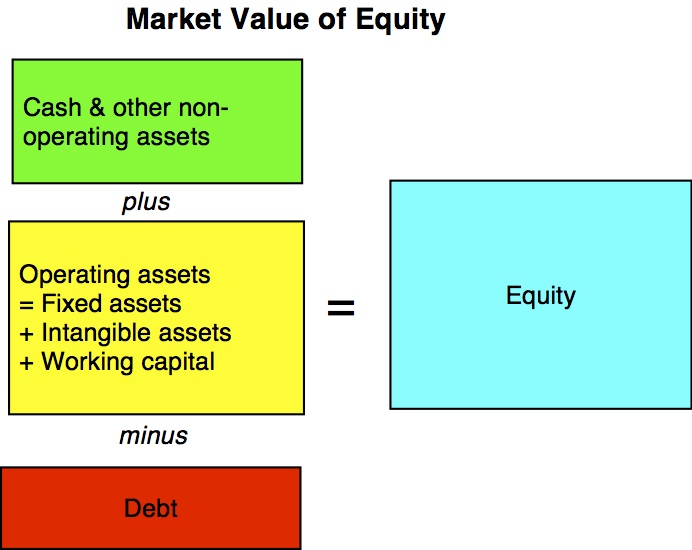

Now if we talk about the market value of a company, it is the value of the public company.

Fair Market Value vs. The Real World - Mercer Capital

It is popularly known as Market Capitalization. Market Value is the result obtained through the multiplication of the total number of shares with the current market price per share.

It is a certain amount, but its basis is not definite, i. There are end number of factors can influence the market value of a company like profitability, performance, liquidity or even a simple news can increase or decrease its market value. Balance Sheet items are shown in book value as per Generally Accepted Accounting Principles GAAP. On the other hand, according to International Financial Reporting Standards IFRS , the assets will be reported on the balance sheet at their fair values.

After the adoption of IFRS, the divergence between the two values will be reduced. Your email address will not be published. Business Finance Banking Education General Law Science IT.

Key Differences Between Book Value and Market Value The major differences between book value and market value are indicated below: The value of assets or securities as indicated by the books of the firm is known as Book Value. Market value is that current value of the firm or any asset in the market on which it can be sold.

Conversely, Market Value shows the current market value of the firm or any asset.

Book Value changes annually, but Market Value changes every next moment. For the calculation of book value, only tangible assets are taken into consideration, but market value considers both tangible as well as intangible assets. Book Value is always readily available, however, the projection of market value on the current market price of a single share, it is not readily available.

What Are the Main Differences Between the Market Value & Book Value of a Stock? - Budgeting Money

When the book value is greater than the market value there is profit, but if the book value is less than the market value there is a loss. However, if these two values coincide, there is a situation of no profit no loss for the company.

Related Differences Difference Between Money Market and Capital Market Difference Between Primary Market and Secondary Market Difference Between Cash Market and Future Market Difference Between Call and Put Option Difference Between Stocks and Bonds. You Might Also Like: Leave a Reply Cancel reply Your email address will not be published. Top 5 Differences Difference Between PERT and CPM Difference Between Developed Countries and Developing Countries Difference Between Management and Administration Difference Between Probability and Non-Probability Sampling Difference Between Pvt Ltd and Public Ltd Company.

New Additions Difference Between Negotiation and Assignment Difference Between Competitive Advantage and Core Competence Difference Between Cost Sheet and Production Account Difference Between Cost Allocation and Cost Apportionment Difference Between Joint Product and By-Product Difference Between Pooling of Interest Method and Purchase Method Difference Between Traditional Budgeting and Zero-Based Budgeting Difference Between Internal and External Reconstruction Difference Between Open-Ended and Closed-Ended Mutual Funds Difference Between Decree and Order.