How to determine whether a stock is overvalued

Overvaluation may result from an emotional buying spurt, which inflates the stock's market price , or from a deterioration in a company's financial strength.

Value Investing: Finding Undervalued Stocks

Potential investors do not want to overpay for a stock. A small group of staunch efficient market theorists believe the market is perfectly efficient.

They believe that fundamental analysis of a stock is a wasted exercise because the stock market is all-knowing; as such, stocks are never undervalued or overvalued. Fundamental analysts think otherwise.

For them, there are always opportunities to find undervalued and overvalued stocks, because the market is as irrational as its participants.

Fundamental analysts look for two conditions in stock market analysis: Undervalued stocks are offered to investors at a discount , but overvalued stocks are trading at a premium. Overvalued stocks are ideal for investors looking to short a position; that is, selling shares with the intention of buying them when the price is in line with the market.

Error (Forbidden)

Overvalued stocks may also be legitimately trading at a premium due to brand, goodwill, better management or other factors that increase the value of one company's earnings over another. The most common way to determine if a stock is overvalued uses relative earnings.

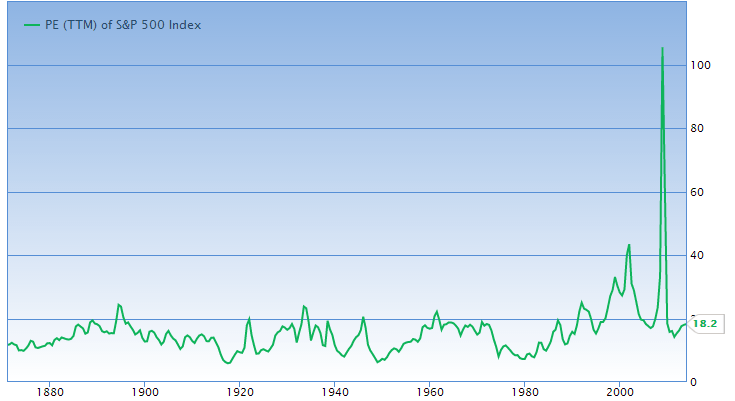

Relative earnings analysis involves comparing earnings to some market value , such as price. A company that's trading at a price 50 times its earnings is considered to be trading at a much higher multiple than a company trading for 10 times its earnings.

In fact, the company trading for 50 times its earnings is most likely to be overvalued. Dictionary Term Of The Day.

A measure of what it costs an investment company to operate a mutual fund. Latest Videos PeerStreet Offers New Way to Bet on Housing New to Buying Bitcoin? This Mistake Could Cost You Guides Stock Basics Economics Basics Options Basics Exam Prep Series 7 Exam CFA Level 1 Series 65 Exam.

How To Tell When a Stock Is Overvalued

Sophisticated content for financial advisors around investment strategies, industry trends, and advisor education. Overvalued Fundamental analysts look for two conditions in stock market analysis: How to Find Overvalued Stocks The most common way to determine if a stock is overvalued uses relative earnings. Stock Market Capitalization To Fully Valued Forward Price To Earnings - Forward Earnings Yield Relative Valuation Model. Content Library Articles Terms Videos Guides Slideshows FAQs Calculators Chart Advisor Stock Analysis Stock Simulator FXtrader Exam Prep Quizzer Net Worth Calculator.

Error (Forbidden)

Work With Investopedia About Us Advertise With Us Write For Us Contact Us Careers. Get Free Newsletters Newsletters. All Rights Reserved Terms Of Use Privacy Policy.