Pricing currency options based fuzzy techniques

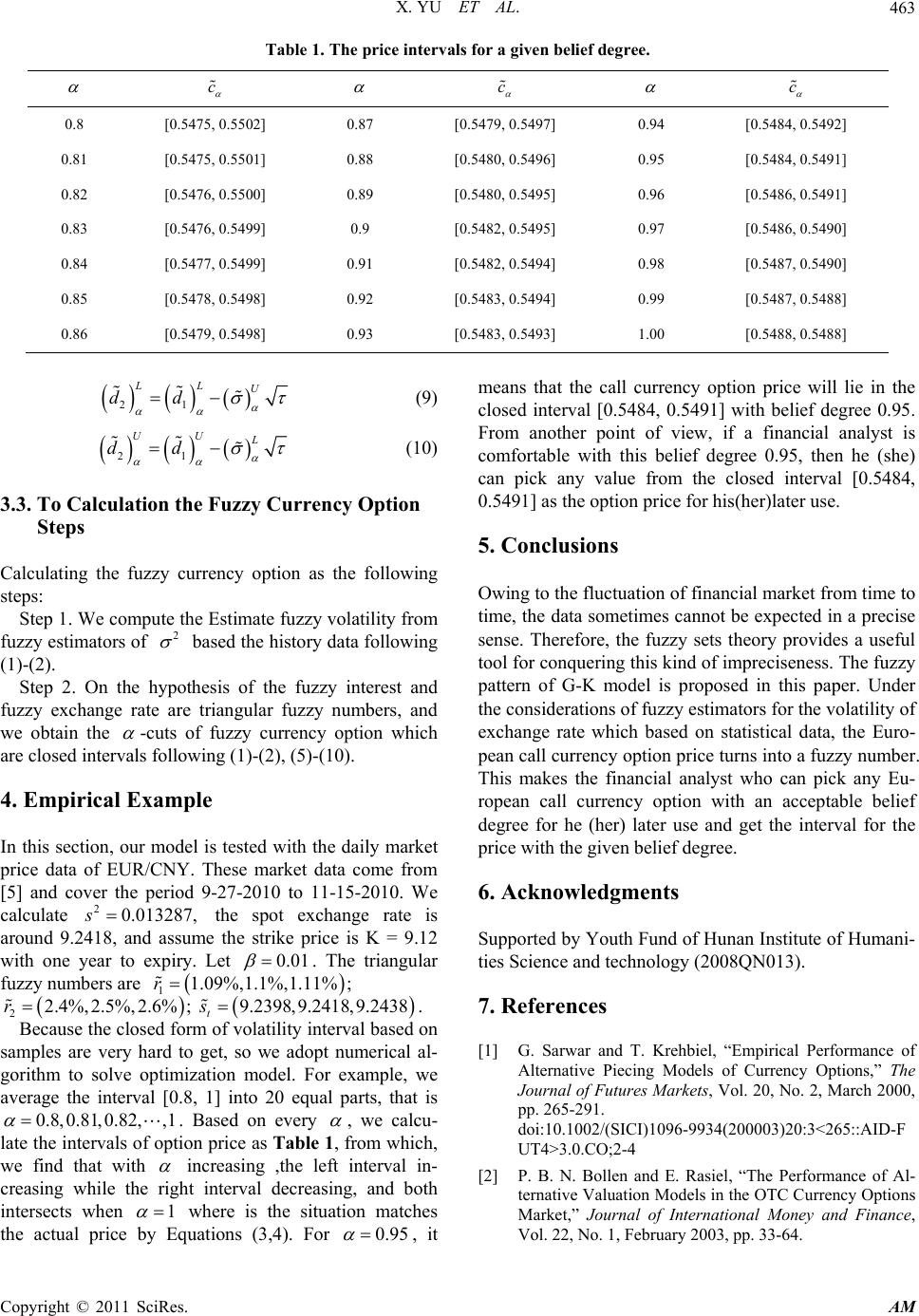

Owing to the fluctuation of financial markets from time to time, some financial variables can always be observed with perturbations and be expected in the imprecise sense. Therefore, this paper starts from the fuzzy environments of currency options markets, introduces fuzzy techniques, and gives a fuzzy currency options pricing model. By turning exchange rate, interest rates and volatility into triangular fuzzy numbers, the currency option sponsorship for stock broker license australian will turn into a fuzzy number.

This makes the financial investors who can pick any currency option price with an acceptable belief degree for their later use. In order to obtain the belief degree, an optimization procedure has been applied.

Pricing currency options based on fuzzy techniques

An empirical study is pricing currency options based fuzzy techniques based on daily foreign exchange market data. The empirical study results indicate that the fuzzy currency options pricing method is a useful tool for modeling the imprecise problem in the real world.

Finance Pricing Fuzzy sets Currency options.

Skip to main content Search Data Providers Services Blog About Contact us. Research Papers in Economics. If you think this content is not provided as Open Access according to the BOAI definition then please contact us immediately.