Stock option valuation excel

Black-Scholes Option Value | M&A Model | Macabacus

Home Products FinTools XL OPTIONS XL. OPTIONS XL is a Microsoft Excel add-in program that allows you to value options on stocks, foreign exchange, futures, fixed income securities, indices, commodities and Employee Stock Options ESOs using custom functions. Market data from your quote vendor can be automatically passed to the custom functions via Dynamic Data Exchange.

OPTIONS XL | FinTools

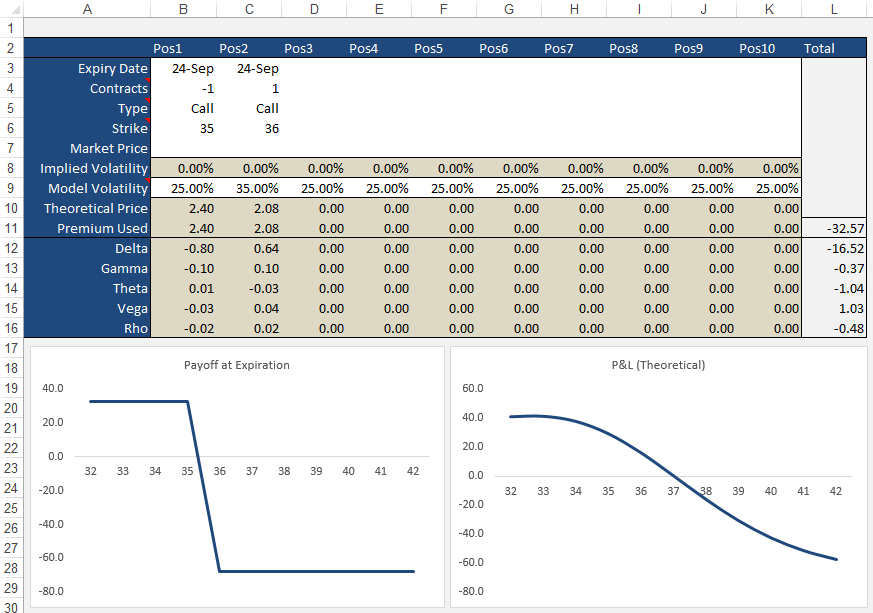

Options functions include Theoretical Value, Delta, Gamma, Theta, Vega, Rho, Psi, Lambda, Intrinsic Value, Implied Volatility and many more. Employee stock option valuation: Share-based Payment Navigator, FAS Wizard, Volatility Wizard, Peer Group Volatility, Flexible Monte Carlo Exercise Behaviour and more.

Solutions fair value ASC ASC ASC Products software FinTools XL OPTIONS XL EXOTICS XL BONDS XL UTILITY XL RISK XL Software Authentication Statement FAS Toolkit Feature Comparison Function Comparison Option Tracker OT Administration OT Valuation Financial Reporting FinCalcs BondsCalc ExoticsCalc OptionsCalc VolatilityCalc Lattice Option-Pricing Model Services consulting ASC ESO Valuation PPT Valuation TSR Valuation Expected Term Expected Volatility Expected Volatility Template Historical Volatility Implied Volatility Peer Group Volatility Volatility Estimation Process Outlier Analysis ASC ASC Plan Design Training Seminars Support updates Support Request Updates Feedback Support Grid Resources calculators Publications White Papers Best Practice Series Working Papers Blog Learning Financial Data Online Calculators OptionsCalc Online ExoticsCalc Online ProbabilityCalc VolatilityCalc About company About Us Contact Staff Customers Testimonials Target Markets Careers.

OPTIONS XL Home Products FinTools XL OPTIONS XL.

OPTIONS XL | FinTools

FinTools XL OPTIONS XL EXOTICS XL BONDS XL UTILITY XL RISK XL Software Authentication Statement FAS Toolkit Feature Chris moneymaker casino spokesperson Function Comparison Option Tracker OT Administration OT Valuation Financial Reporting FinCalcs BondsCalc ExoticsCalc OptionsCalc VolatilityCalc Lattice Option-Pricing Model.

Some of the ways that OPTIONS XL may be used are: Non-dividend paying equities the original Black: Futures financials, energy, FX, commodities Garman-Kohlhagen: Spot stock option valuation excel exchange Modified Black-Scholes: Dividend yield input equities, indices, bonds Whaley: Assets with a continuous yield Values American-style early-exercise Eurodollar: Eurodollar and bill futures optionsBlack-Scholes, Whaley and Binomial Pseudo-American B-S: Dividend paying equities, discrete dividends nearest-dividend dates B-S French: Assets generating discrete cash flows dividends Full early exercise considerationDiscrete how do i get bitcoins on silkroad flows or yield inputAmerican, European and Bermuda style exercise.

Flexible Binomial C-R-R and Hull Methods: Flexible input of key option variablesDiscrete cash flows or yield inputMultiple interest rates yield curve, forward curve Changes in yield over time, dilution effectsAmerican, European and Bermuda style exerciseIdeal for Warrants, Index Options, OTC Options, ESOs. Method of Lines Carr: An efficient, accurate analytical valuation of American-style options.

Based on the work of Peter Carr, formerly of Cornell University. Constant Elasticity of Variance model calculates option values based on non-constant volatility assumptions. Option Portfolio Optimization of OEX and stock option contracts. Real Options and Capital Project analysis using option pricing theory.

Calculates option values for returns that do not follow the normal distribution. Calculates option values considering the employee exercise behavior using Monte Carlo simulation.

Calculates the values of American-style options using several lattice or tree methods. Binomial, Enhanced Binomial and Trinomial techniques are included in this set.

Schedule your free live demo today. Address Federal Street Suite Camden, NJ Follow Us Twitter LinkedIn.

FRM: Using Excel to calculate Black-Scholes-Merton option price