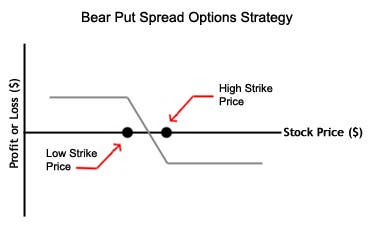

Bear put option spread strategy

A Bear Debit Put Spread, also known as a Vertical Put Spread, is a bearish position taken when you expect a modest downward price movement in a defined time frame. This spread is made up by buying a Put and writing a Put with a lower strike in the same expiration month.

Since the Buy Put has a higher strike price with a higher premium cost than the Write Put, you will be paying out more premium than you will be collecting, creating a debit. Since the Buy Put covers the Write Put, there is no margin requirement, and the theoretical maximum loss is the debit paid. The Bear Debit Spread benefits when the underlying asset falls to the level of the strike price of the Write Put. All support, education and training services and materials on the TradeStation Web site are for informational purposes and to help customers learn more about how to use the power of TradeStation software and services and to help provide other customer support.

No type of trading or investment recommendation, advice or strategy is being made, given or in any manner provided by TradeStation Securities, Inc.

TradeStation provides the user the ability to analyze, design, test and optimize forex trading strategies, but does not provide forex dealer, counterparty or brokerage services of any kind. Options trading is not suitable for all investors. Please click here to view the document titled Characteristics and Risks of Standardized Options.

Bear Put Spread - Profit & Loss Graph

Call a TradeStation Specialist Past performance, whether actual or indicated by historical tests of strategies, is no guarantee of future performance or success. Your account application to trade options will be considered and approved or disapproved based on all relevant factors, including your trading experience. View the document titled Characteristics and Risks of Standardized Options. System access and trade placement and execution may be delayed or fail due to market volatility and volume, quote delays, system and software errors, Internet traffic, outages and other factors.

Neither the Company, nor any of its associated persons, registered representatives, employees, or affiliates offer investment advice or recommendations. The Company may provide general information to potential and prospective customers for the purposes of making an informed investment decision on their own. All proprietary technology in TradeStation is owned by TradeStation Technologies, Inc. Equities, equities options, and commodity futures products and services are offered by TradeStation Securities, Inc.

Skip to main content Skip to main navigation. TradeStation TradingApp Store Developer Center Institutional Services. Chatting With A TradeStation Representative. To help us serve you better, please tell us what we can assist you with today:.

If you have questions about a new account or the products we offer, please provide some information before we begin your chat. If you are a client, please log in first. Education University Markets Articles Options Bear Debit Put Spread. University Learning TradeStation TradeStation Basics Strategy Trading EasyLanguage Markets.

Articles Forex Introduction to Forex Benefits and Risks of Trading Forex Forex Trading Specifications Costs of Trading Forex Carry Trade and Roll Over Calculating Forex Trading Profit and Loss Futures Options Determining Factors of an Options Premium Understanding Volatility Concepts The Greeks Options Strategies Reading a Position Graph Buy Put Write Call Write Put General Options Spread Strategy Theory Options Strategies Reading a Position Graph General Options Multi-leg Strategy Theory Long Buy Straddle Long Buy Strangle Long Buy Butterfly Long Buy Condor Long Calendar Spread Stocks Trading Glossary Books Events.

Bear Put Debit Spread Vertical Options Strategy Long 1 XYZ OCT 43 Put 2.

Realtime Option Strategy Screeners and Analyzers for American Stock Exchanges

Maximum loss is realized at expiration at the strike price of the options bought 43 or greater. Risk Factor Effect Price Sensitivity Delta Position profit increases in value by the Delta value as the underlying asset price falls. Time Decay Theta Position profit increases or decreases in value by the Theta value based on the asset price in relation to the strike prices.

Volatility Sensitivity Vega Position profit increases or decreases in value by the Vega value depending on the asset price in relation to the strike prices.

Bear Put Spreads: A Roaring Alternative To Short Selling

Check the background of TradeStation Securities, Inc. Sitemap Contact Us About Us FAQ Terms of Use Security Center Privacy Policy Customer Agreements Other Information Careers. Price Sensitivity Delta Position profit increases in value by the Delta value as the underlying asset price falls.