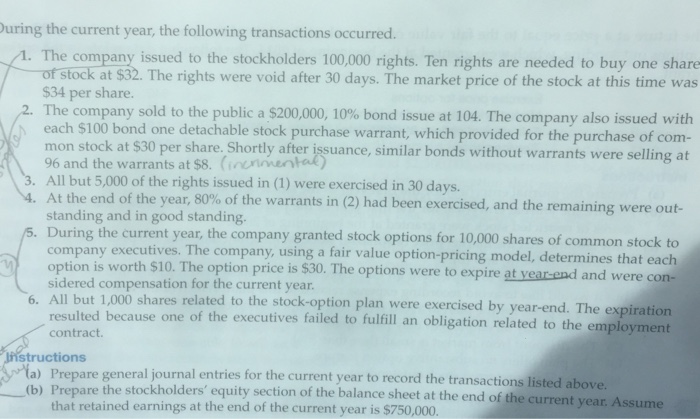

Expiration of stock options journal entry

An expiration date in derivatives is the last day that an options or futures contract is valid. When investors buy options, the contracts gives them the right but not the obligation, to buy or sell the assets at a predetermined price, called a strike pricewithin a given time period, which is on or before the expiration date.

If an investor chooses not to exercise that right, the option expires and becomes worthless, and the investor loses the money paid to buy it. However, when that Friday falls on a holiday, the expiration date is on the Thursday immediately before the third Friday. Once an options or futures contract passes its expiration date, the contract is invalid.

3 Ways to Account for Stock Based Compensation - wikiHow

The last day to trade equity options is the Friday prior to expiry. Some options have an automatic exercise provision. These options are automatically exercised if they are in-the-money at the time of expiry.

3 Ways to Account for Stock Based Compensation - wikiHow

The Options Clearing Corporation OCC automatically exercises a call or put option that is at least one cent in-the-money. In general, the longer a stock has to expiration, the more time it has to reach its strike price, the price at which the option becomes valuable. In fact, time decay is represented by the dshort.com is the stock market cheap theta in option pricing theory. Theta is one of expiration of stock options journal entry Greek words used to reference the value drivers on derivatives.

The other three 'Greeks' are kelas forex di johor bahru, gamma and vega.

All other things equal, the more time an option has until expiration, the more valuable it is. There are two types of derivative products, calls and puts. Calls give the holder the right, but not the obligation, to buy a stock if it reaches a certain strike price by the expiration date.

Puts give the holder the right, but not the obligation, to sell a stock if it reaches a certain strike price 24 binary options money management review the expiration date.

This is why the expiration date uob myr exchange rate so important to options traders.

The concept of time is at the heart of what gives options their value. After the put or call expires, it does not exist. In other words, once the derivative expires the investor does not retain any rights that go along with owning the call or put.

Dictionary Term Of The Day. A measure of what it costs an investment company to operate a mutual fund. Latest Videos PeerStreet Offers New Way to Bet on Housing New to Buying Bitcoin?

This Mistake Could Cost You Guides Stock Basics Economics Basics Options Basics Exam Prep Series 7 Exam CFA Level 1 Series 65 Exam. Sophisticated content for financial advisors around investment strategies, industry trends, and advisor education.

Expiration Date Derivatives Share. What is an 'Expiration Date Derivatives ' An expiration date in derivatives is the last day that an options or futures contract is valid. Expiration and Option Value In general, the longer a stock has to expiration, the more time it has to reach its strike price, the price at which the option becomes valuable.

Expiration Time Call On A Call Call Option Currency Option Stock Option Put Calendar Early Exercise Exercise Deferred Payment Option.

Option (finance) - Wikipedia

Content Library Articles Terms Videos Guides Slideshows FAQs Calculators Chart Advisor Stock Analysis Stock Simulator FXtrader Exam Prep Quizzer Net Worth Calculator. Work With Investopedia About Us Advertise With Us Write For Us Contact Us Careers. Get Free Newsletters Newsletters. All Rights Reserved Terms Of Use Privacy Policy.