Mortgage rates stock market crash

Although inflation expectations are the primary factor that influence the direction of mortgage rates on a day-to-day basis the stock market can also have an impact. So, to understand how the stock market can influence mortgage rates we have to understand how they impact the price of bonds. Stocks and bonds compete for the same investment dollar.

In other words, an investor with money to invest has to make a decision to invest their money in either the stock market or in the bond market it should be noted that there are other investment options but these two classes are the primary vehicles for investment capital.

For an investor stocks are generally thought to provide higher returns over time but also come with greater volatility. Conversely, bonds tend to have lower returns over time but have less volatility. Therefore, in general, when the stock market goes down it is a sign that investors are selling stocks and shifting their capital into bonds.

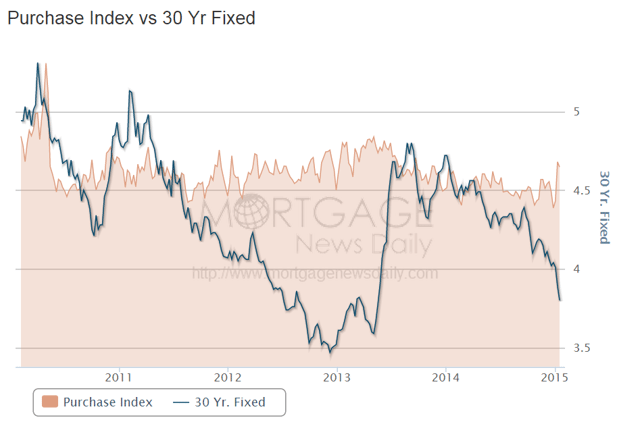

This boosts bond prices and drives mortgage rates down. Conversely, when the stock market rallies it is a sign that investors are selling bond positions in order to shift capital into the stock market. The greater supply of bonds on the market drives prices lower and pushes mortgage rates higher. The Dow Jones Industrial Average is currently trading over points lower after a slew of […]. We know that often times the stock market and bond market can trade inversely which could put pressure on mortgage rates to move […].

For an explanation on how a weak stock market can help lower mortgage rates read this link. The problems stemming from the US credit crunch have been exported overseas. Our secondary focus tends to be on the inverse relationship between stocks and bonds.

However, this correlation has not held true either over the previous few […]. This is because when money flows out of stocks it typically finds its way into the bond market […].

Please refer to this blog posting to see how. Read this blog entry to find out why the stock market is pulling money away from […]. Although different analysts have different opinions it seems as though the financial sector […].

US Housing Market In Peril As "Increase In Mortgage Rates Has Shocked Consumers" | Zero Hedge

Click this link to read how the stock market impacts mortgage […]. With the lack of any significant economic data out today we expect mortgage rates to take direction from the stock market.

Signs of economic stabilization have helped stocks move into positive […]. Both reports are weighing on the stock market which has helped mortgage rates recover ground from […]. Investor sentiment around the world has taken a more […]. The Dow Jones Industrial Average is off by almost points since Monday. We expect mortgage rates to take direction from stocks which are currently trading […].

The Dow Jones Industrial Average is currently off points in […]. You can read here why this can impact mortgage rates. Stocks are rallying on better than expected earnings reports from Intel […].

Not by coincidence mortgage rates also moved higher last week. If their earnings are healthy as well we will likely see rates pressured higher and vice versa.

Good news for the economy is typically bad news for mortgage […]. Typically when stocks are higher it is driving the price of […].

The Commerce Department released the latest GDP report which showed that the […]. Stocks are reacting to a better than expected manufacturing report which […].

Stocks and bonds often trade inversely with each other which is what is happening […]. Stocks and bonds compete for the same investment dollar so when the equity markets rally it is often at the expense […]. If these reports are surprisingly healthy mortgage rates are likely to suffer and vice […].

When stocks suffer mortgage rates often benefit. Gold prices-past 12 […]. Both US and European stock markets are lower which should help interest rates remain […]. On that news stocks are trading higher which could pressure mortgage rates higher later […]. Stocks are lower which is helping mortgage rates. Typically a rally in the stock market would cause mortgage rates to move higher but clearly there is a dichotomy in the market. One school of thought forecasts a rosier outlook […].

Thus far stocks are trading lower on this news which is helping mortgage rates. When stocks rally it often puts upward pressure on mortgage […]. Bad news for the economy is often good news for mortgage […]. The Commerce Department reported this morning that 2nd quarter GDP growth was more sluggish than […].

umypecodayok.web.fc2.com | Get Rates

Stocks are trading higher on better-than-expected construction […]. The move comes on the heels of the weak economic data and the Fed policy statement […]. The National Association of Realtors reported this […]. Good news for the economy is often bad news for mortgage […]. Mortgage-backed bond prices have now slipped below important layers of technical support. Better than expected housing data would likely boost stocks and hurt mortgage rates and vice […]. Typically better-than-expected economic data is good for stocks and bad for rates but the markets are not reacting thus […].

Earlier in the day it looked as if mortgage rates would be pressured higher on economic data that was in line or better than analysts were expecting good news is good for stocks but bad for rates. The news has sent stocks higher which would ordinarily be bad news for mortgage […].

This has got investors optimistic about the broader economic recovery. Good news for the economy is good for stocks but bad for mortgage rates. I still believe a long-term locking trend is […]. Stocks like certainty and they are rallying this morning which is putting pressure on rates to move […]. This is good news for the economy but bad news for mortgage rates.

This may be a sign of things to come because the US Dollar is currently trading at decade lows versus foreign currencies. Takeover announcements typically help stocks to trade higher because businesses are usually acquired at a premium to their stock price AND as we know what is good for stocks is often bad for mortgage rates. Over the past 3 months the relationship between stocks and interest rates is very clear.

Stocks have rallied pushing rates higher: This would likely support bond prices and push yields lower so I will switch my outlook to neutral. I expect rates to remain unchanged until Friday when […].

Mortgage rates hold above 4% - MarketWatch

This could put pressure on rates to move higher. Since rates are still at the lower end of recent ranges I would recommend […]. Stocks are trading lower on the news which is helping to stabilize rates. This helped mortgage-backed bonds rally which is why pricing on mortgage rates are improved this […]. CLICK HERE to understand how the stock market impacts mortgage rates.

The Dow Jones Industrial Average […]. The flight-to-safety which helped mortgage […]. Japanese officials announced overnight that tap water in Tokyo has higher than allowed levels of radioactive iodine. Bad news for the economy is typically good news for mortgage rates and mortgage rates have sunk to the best levels since January.

I still believe that mortgage rates will finish […]. On this news stocks are trading higher which is putting pressure on rates once […]. The optimism helped push US stocks to the highest weekly gain in 2 years and pushed mortgage rates higher by.

In early morning trading the Dow Jones Industrial Average was up […]. Stocks are trading lower again today which is helping to keep interest rates low.

In general, when stocks drop rates also follow and that is what is currently taking place. Stocks may be heading for an 8th staright day of […]. Yesterday stocks declined which helped mortgage rates to improve.

Stocks are trading slightly higher in early morning trade. I expect mortgage rates to remain […]. Investors are optimistic that the Fed will uncover a 3rd round of quantitative easing later this […]. US stocks started the morning higher but have since reversed into negative territory which may open the door for rates to stabilize or even move lower.

AT THIS POINT I EXPECT RATES TO REMAIN IN A TIGHT RANGE UNTIL FRIDAY'S SPEECH IN JACKSON HOLE, WY […]. Markets here in the US and in Europe are higher today on positive […]. Investors are shifting their capital away from stocks and into longer-duration US […].

Analysts are expecting European officials to release details about a plan to re-capitalize […]. Following a weaker than expected earnings report from financial giant JP Morgan Chase US stocks […].

Details of the complex plan are still being analyzed by the markets but the initial reaction has been positive for stock markets around the world and negative for interest rates.

In general good news for the economy is bad news for mortgage rates and vice versa. However, over the past couple months domestic economic data has been trumped by developments in […].

Bad news for the economy is often good news for mortgage rates yet rates are unable to break below the current technical level.

How Do Interest Rates Affect the Stock Market? | Investopedia

You might as well float until […]. Good news for the economy is often bad news for mortgage rates. On the news equity markets around the world, including here in the US, are all trading sharply higher which is not welcome news for mortgage rates. Today, stocks are trading modestly lower while rates are fairly steady. New claims for […]. Bad news for the economy is often good news for mortgage rates. Good news for the economy is bad news for mortgage rates.

Typically, good news for the economy is bad news for mortgage rates but rates are steady so […]. However, rates remain low possibly because of the long list of economic data due out the rest of […]. This is the largest one week decline since September of From a technical perspective the year Treasury yield has broken through important technical […]. Similarly, when stocks rally it typically draws capital out of the bond market which has the effect of pushing rates higher and […].

Normally good news for the economy is is bad news for mortgage rates. However, in the same release the Labor Department revised the previous weeks figure by […]. Anxiety over the economy helps mortgage rates remain low. When stocks trade lower it typically helps mortgage rates move lower. When stocks move higher it often pressures rates higher as well. Bad economic news is good for interest rates. Bad news for stocks is often good news for interest rates. However, I remain skeptical of the strength of this recovery and Europe remains a big question […].

How will interest rates respond? Should Governor Romney be elected stocks are likely to rally on his business friendly platform and that could push rates up by. The Dow Jones Industrial Average has lost about 1, points in the past month but mortgage […]. Thus far this morning stocks are trading lower and US interest rates remain low. How long will this trend last? No one knows for certain but the near-term conditions do not alter my end of year outlook which calls for higher interest rates so locking in today probably will not look bad in the long run.

The major US stock indexes increased by 1. When stocks climb in price it tends to pressure interest rates higher. Good news for the economy is often bad news for mortgage rates but they appear to be holding steady thus […]. Durable goods orders, the Case-Shiller Home Price Index, Consumer Confidence, and initial jobless claims were all reported better than expected.

Normally this would cause mortgage rates to rise. Therefore, I expect mortgage rates to respond to the stock market SEE HERE. Today, for example, monthly Retail Sales were reported stronger than expected. Last week we saw lower than expected jobless claims and hotter than expected wholesale inflation figures. Generally speaking good news for the economy is bad news for interest rates. For a second straight week new filings for unemployment claims remained at per-recession levels.

This may be a signal that the labor market is continuing to normalize. Good news for the economy can be bad news for mortgage rates.

Also good for mortgage rates is low inflation figures. The Personal Consumption Price Index, […]. Stocks are higher and bonds are lower to start the […]. Lastly, a survey from the New York Federal Reserve Bank showed that manufacturing activity in the Empire region was much stronger than expected last month. Good news for the economy is typically bad news for mortgage rates.

In general, the financial markets seem to be cautious with regard to equity valuations.

Iraq is the 7th largest oil exporter in the world so any disruption to the oil supply would threaten the already fragile global economy. Bad news for the economy is good for interest rates. The report from the Department of Commerce showed that the US economy contracted at a 2.

Of course analysts are blaming the bad weather but regardless the report will make it difficult for the US economy to achieve significant growth in Bad news for the economy is good news for mortgage rates. Notify me of follow-up comments by email. Notify me of new posts by email. FOMC does not directly set home loan rates but About 5 hours ago. June 19, 9: June 15, 3: June 12, Content by Evan Swanson. Home Mortgage Blog Team Swanson Philosophy Testimonials Apply For A Mortgage Contact Search for: About Evan My blog is a tool for me to provide updates on what is happening in the financial markets that will impact mortgage rates, update professional partners on what is happening in the mortgage industry, and write about general financially related topics.

Rate Update May 8, Rate Update May 9, The Personal Consumption Price Index, […] Mortgage Rate Update May 12, Evan Swanson, CFPEvan Swanson, CFP - May 12, […] no significant economic news out today mortgage rates are taking direction from stocks and technical trading patterns.

Stocks are higher and bonds are lower to start the […] Mortgage Rate Update May 15, Evan Swanson, CFPEvan Swanson, CFP - May 15, […] In addition, weekly jobless claims released today showed the number of people filing for new unemployment benefits fell to the lowest level in 7 years.

Should […] Mortgage Rate Update June 16, Evan Swanson, CFPEvan Swanson, CFP - June 16, […] The US is ordering some officials out of the country in response to renewed violence between Sunni militants and the government. Leave a Reply Click here to cancel reply. Comment Name Required Email Required Website Notify me of follow-up comments by email.

About This Blog "My Mind on Mortgages" is a tool to provide daily updates on what is happening in the financial markets that will impact mortgage rates, update professional partners on what is happening in the mortgage industry, and write about general financially related topics. I'm always trying to expand "My Mind" so if you have something useful to add I'd encourage you to do so by leaving a comment at the bottom of a blog posting!

I hope you find it informative! Swanson Home Loans on Twitter FOMC does not directly set home loan rates but Archives Archives Select Month June May April March February January December November October September August July June May April March February January December November October September August July June May April March February January December November October September August July June May April March February January December November October September August July June May April March February January December November October September August July June May April March February January December November October September August July June May April March February January December November October September August July June May April March February January December November October September August July June May April March February January December November October September August July June May April March February The views and opinions expressed in this site are those of the author s and do not necessarily reflect the official policy or position of Mortgage Trust, Inc.

This is for informational purposes only. This is not a commitment to lend. Terms and conditions of programs, products, and services are subject to change.

All loans are subject to credit and property approval. Certain restrictions may apply on all programs. NMLS Consumer Access Evan Swanson NMLS Mortgage Trust, Inc NMLS Rate and Program Disclosures.